UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

|

Macatawa Bank Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

| |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount Previously Paid:

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

10753 Macatawa Drive

Holland, Michigan 49424

March 23, 2012

Dear Shareholder:

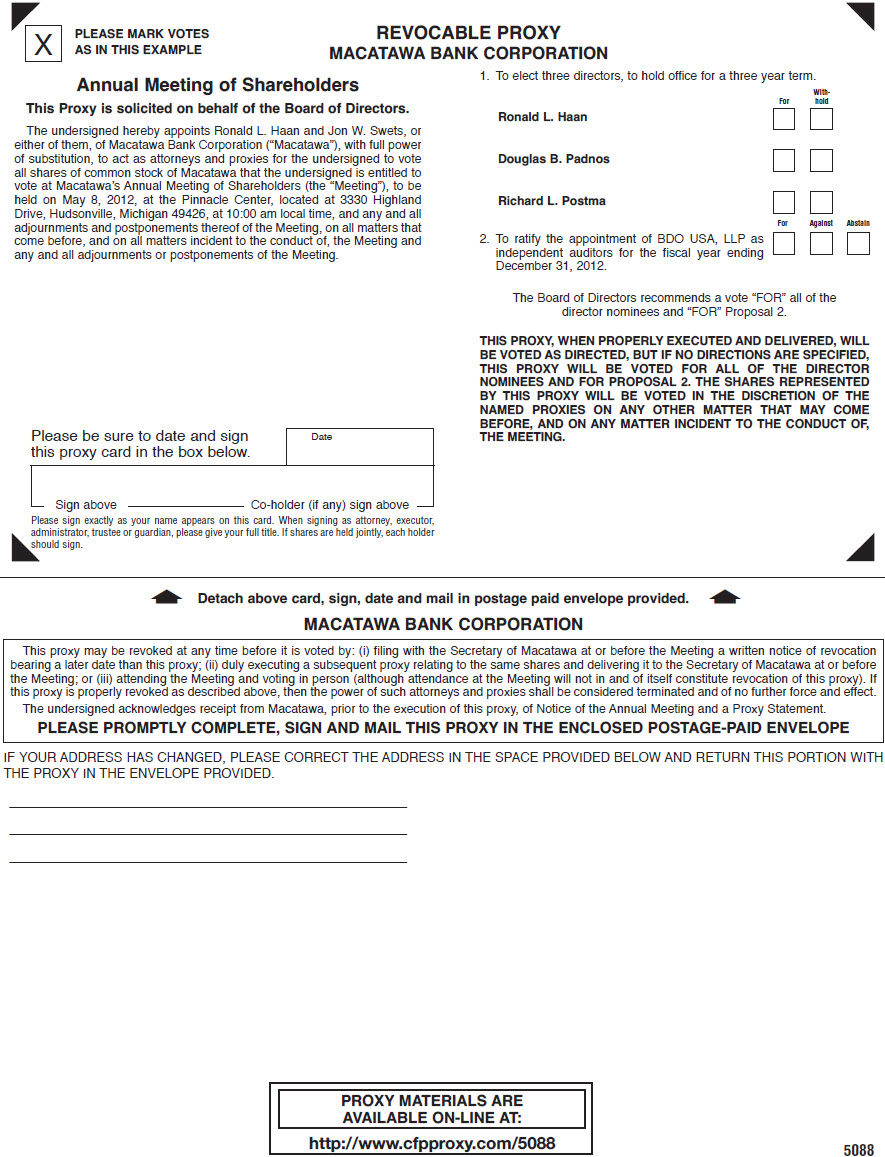

We cordially invite you to attend our 2012 annual meeting of shareholders. The meeting will be held on Tuesday, May 8, 2012, at 10:00 a.m. local time, at The Pinnacle Center, 3330 Highland Drive, Hudsonville, Michigan 49426.

At the meeting, we will elect directors and ratify appointment of our independent auditors. We will also present a report on our business.

We have enclosed a notice of the meeting and our proxy statement. The proxy statement includes information about the nominees for director, the proposal to ratify appointment of our independent auditors, information about the different methods you can use to vote your proxy, and other important information. Also enclosed is our annual report for the year ended December 31, 2011. You should read these documents carefully.

It is important that your shares be represented at the annual meeting, regardless of how many shares you own. Please sign, date and return the enclosed proxy as soon as possible, regardless of whether or not you plan to attend the annual meeting. Voting your shares before the meeting will not affect your right to vote in person if you attend the meeting.

| |

Sincerely,

|

| |

|

| |

Richard L. Postma |

| |

Chairman of the Board

|

|

Your vote is important. Even if you plan to attend the meeting,

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY.

|

MACATAWA BANK CORPORATION

10753 Macatawa Drive

Holland, Michigan 49424

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

The 2012 annual meeting of shareholders of Macatawa Bank Corporation will be held at The Pinnacle Center, 3330 Highland Drive, Hudsonville, Michigan 49426, on Tuesday, May 8, 2012, at 10:00 a.m. local time. At the meeting, we will consider and vote on:

| |

1.

|

Election of three directors for a term of three years; and

|

| |

2.

|

Ratification of the appointment of BDO USA, LLP as the Company's independent registered public accounting firm for the year ending December 31, 2012.

|

We will also conduct any other business that properly comes before the meeting or at any adjournment of the meeting.

You are receiving this notice and can vote at the meeting and any adjournment of the meeting if you were a shareholder of record on March 19, 2012. The enclosed proxy statement is first being sent to our shareholders on approximately March 23, 2012. A copy of our annual report for the year ended December 31, 2011 is enclosed with this notice.

Important Notice Regarding the Availability of Proxy Materials: Our proxy statement and annual report for the year ended December 31, 2011, which accompany this notice, are available for viewing, printing and downloading on the Internet at www.cfpproxy.com/5088 or in the "Investor Relations" section of our website, www.macatawabank.com, by clicking the "Documents/SEC Filings/Annual Report" link. In addition, you may obtain free of charge electronic copies of all of our filings with the U.S. Securities and Exchange Commission from this section of our website.

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| Jon W. Swets |

| Secretary |

| March 23, 2012 |

|

Your vote is important. Even if you plan to attend the meeting, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY.

|

MACATAWA BANK CORPORATION

PROXY STATEMENT

dated March 23, 2012

For the Annual Meeting of Shareholders

to be held May 8, 2012

Introduction

Questions and Answers about the Proxy Materials and Our 2012 Annual Meeting

|

Q.

|

Why am I receiving these materials?

|

|

A.

|

The Company's Board of Directors is providing these proxy materials to you in connection with its solicitation of proxies for use at the Macatawa Bank Corporation 2012 annual meeting of shareholders. The meeting will take place on Tuesday, May 8, 2012, at 10:00 a.m., local time, at The Pinnacle Center, 3330 Highland Drive, Hudsonville, Michigan 49426. You are invited to attend the meeting and are requested to vote on the proposals described in this proxy statement.

|

|

Q.

|

What information is contained in these materials?

|

|

A.

|

The information included in this proxy statement discusses the proposals to be voted on at the meeting, the voting process, the compensation of named executive officers and directors, and other important information. Your proxy, which you may use to vote on the proposals described in this proxy statement, is also enclosed.

|

|

Q.

|

When did the Company begin sending and delivering this proxy statement to shareholders?

|

|

A.

|

We began sending and delivering this proxy statement to our shareholders on approximately March 23, 2012.

|

|

Q.

|

What proposals will be voted on at the annual meeting?

|

|

A.

|

Two proposals will be voted on at the annual meeting:

|

|

|

(1)

|

Election of three directors for a term of three years; and

|

|

|

(2)

|

Ratification of the appointment of BDO USA, LLP as the Company's independent registered public accounting firm for the year ending December 31, 2012.

|

|

|

In addition, any other business that properly comes before the meeting will be considered and voted on. As of the date of this proxy statement, we are not aware of any other matters to be considered and voted on at the meeting.

|

|

Q.

|

How does the Company's Board of Directors recommend that I vote?

|

|

A.

|

Your Board of Directors recommends that you vote, as follows:

|

|

|

(1)

|

FOR election of all director nominees; and

|

|

|

(2)

|

FOR ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2012.

|

|

A.

|

You may vote at the annual meeting if you were a shareholder of record of Macatawa common stock at the close of business on March 19, 2012. Each shareholder is entitled to one vote per share of Macatawa common stock on each matter presented for a shareholder vote at the meeting. As of March 19, 2012, there were 27,082,823 shares of Macatawa common stock outstanding.

|

|

A.

|

If you properly sign and return the enclosed proxy, the shares represented by that proxy will be voted at the annual meeting and at any adjournment of the meeting. If you specify a choice on the proxy, your shares will be voted as specified. If you do not specify a choice, your shares will be voted for election of all director nominees and for Proposal 2. If any other matter comes before the meeting, your shares will be voted in the discretion of the persons named as proxies on the proxy.

|

|

Q.

|

How do I vote if I hold my shares in "street name"?

|

|

A.

|

If you hold your shares in "street name," which means that your shares are registered in the name of a bank, broker or other nominee (which we collectively refer to as your "broker"), your broker must vote your street name shares in the manner you direct if you provide your broker with proper and timely voting instructions. Please use the voting forms and instructions provided by your broker or its agent. These forms and instructions typically permit you to give voting instructions by telephone or Internet if you wish. If you are a street name holder and want to change your vote, you must contact your broker. Please note that you may not vote shares held in street name in person at the annual meeting unless you request and receive a valid proxy from your broker.

|

|

Q.

|

Does my broker have discretionary authority to vote my shares?

|

|

A.

|

If you do not provide your broker with voting instructions, then your broker has discretionary authority to vote your shares on certain "routine" matters. We expect that Proposal 2 will be considered a routine matter and your broker will have discretionary authority to vote your shares on the proposal. Election of directors is not considered a routine matter and your broker will not have discretionary authority to vote your shares on election of directors. It is important that you promptly provide your broker with voting instructions if you want your shares voted on election of directors.

|

|

Q.

|

Can I change my mind after I return my proxy?

|

|

A.

|

Yes. You may revoke your proxy at any time before it is voted at the meeting by doing any of the following three things:

|

|

|

●

|

by delivering written notice of revocation to Macatawa's Secretary, Jon W. Swets, at 10753 Macatawa Drive, Holland, Michigan 49424;

|

|

|

●

|

by delivering a proxy bearing a later date than the proxy that you wish to revoke; or

|

|

|

●

|

by attending the meeting and voting in person.

|

|

|

Merely attending the meeting will not, by itself, revoke your proxy. Your latest dated valid vote that we receive is the vote that we will count.

|

|

Q.

|

What are broker non-votes?

|

|

A.

|

Generally, broker non-votes occur when shares held by a broker in street name for a beneficial owner are not voted with respect to a particular proposal because the broker has not received voting instructions from the beneficial owner and the broker lacks discretionary voting power to vote those shares.

|

|

Q.

|

What is the quorum requirement for the annual meeting?

|

|

A.

|

To conduct business at the annual meeting, a quorum of shareholders must be present. The presence in person or by properly executed proxy of the holders of a majority of all issued and outstanding shares of Macatawa common stock entitled to vote at the meeting is necessary for a quorum. To determine whether a quorum is present, we will include shares that are present or represented by proxy, including abstentions and shares represented by a broker non-vote on any matter.

|

|

Q.

|

What vote is necessary to approve the proposals?

|

|

A.

|

Election of Directors. A plurality of the shares voting is required to elect directors. This means that, if there are more nominees than positions to be filled, the nominees who receive the most votes will be elected to the open director positions. Broker non-votes and other shares that are not voted in person or by proxy will not be included in the vote count.

|

|

|

Ratification of Appointment of BDO USA LLP. Proposal 2 will be approved if a majority of the shares that are voted on the proposal at the meeting are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on Proposal 2 in person or by proxy will not be included in the vote count.

|

|

|

Required Vote for Other Matters. We do not know of any other matters to be presented at the meeting. Generally, any other proposal to be voted on at the meeting would be approved if a majority of the shares that are voted on the proposal at the meeting are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on the proposal in person or by proxy would not be included in the vote count.

|

|

Q.

|

May the annual meeting be adjourned?

|

|

A.

|

Yes. The shareholders present at the meeting, in person or by proxy, may, by a majority vote, adjourn the meeting despite the absence of a quorum.

|

| |

In addition, our Bylaws allow the Chairman of the Board to adjourn the meeting if a quorum is not present, if disorder arises or if he determines that no further matters may properly come before the meeting.

|

|

|

If a quorum is not present at the meeting, or if the necessary votes to approve any of the proposals described in this proxy statement have not been obtained, we expect to adjourn the meeting to solicit additional proxies.

|

|

Q.

|

What does it mean if I receive more than one proxy or voting instruction card?

|

|

A.

|

It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxies and voting instruction sheets you receive.

|

|

Q.

|

Where can I find the voting results of the annual meeting?

|

|

A.

|

We will announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K that we will file with the Securities and Exchange Commission within four business days after the date of the annual meeting.

|

Use of Terms

In this proxy statement, "we," "us," "our," the "Company" and "Macatawa" refer to Macatawa Bank Corporation, the "Bank" refers to Macatawa Bank, and "you" and "your" refer to each shareholder of Macatawa Bank Corporation.

Proposal 1

Election of Directors

The Governance Committee and the Board of Directors have nominated the following individuals for election as a director of Macatawa for a three-year term expiring at the 2015 annual meeting of shareholders:

Ronald L. Haan

Douglas B. Padnos

Richard L. Postma

Biographical information concerning the nominees appears below under the heading "The Board of Directors."

The persons named as proxies on the proxy intend to vote for the election of each nominee. The proposed nominees are willing to be elected and to serve as a director. If any nominee becomes unable to serve or is otherwise unavailable for election, which we do not anticipate, the incumbent Board of Directors may select a substitute nominee. If a substitute nominee is selected, the shares represented by your proxy will be voted for the election of the substitute nominee. If a substitute is not selected, all proxies will be voted for the election of the remaining nominees.

Your Board of Directors and Governance Committee,

which consists entirely of independent directors,

recommend that you vote FOR election of each nominee as a director.

Proposal 2

Ratification of Appointment of Independent Auditors

The Audit Committee has appointed BDO USA, LLP as the Company's independent registered public accounting firm to audit the financial statements of the Company and its subsidiaries for the year ending December 31, 2012, and to perform such other appropriate accounting services as may be approved by the Audit Committee. The Board of Directors and the Audit Committee, which consists entirely of independent directors, propose and recommend that shareholders ratify the appointment of BDO USA, LLP to serve as the Company's independent registered public accounting firm for the year ending December 31, 2012.

More information concerning the relationship of the Company with its independent auditors appears below under the headings "Audit Committee," "Independent Auditors" and "Audit Committee Report."

If the shareholders do not ratify the appointment of BDO USA, LLP, the Audit Committee will consider a change in auditors for the next year.

Your Board of Directors and Audit Committee,

which consists entirely of independent directors,

recommend that you vote FOR Proposal 2.

The Board of Directors

General

The Board of Directors currently consists of 11 directors. The Board of Directors is divided into three classes, with each class as nearly equal in number as possible. Each class of directors serves a three-year term, with the term of one class expiring at the annual meeting in each successive year.

Qualifications and Biographical Information

The Governance Committee has not established specific, minimum qualifications for director nominees. The Governance Committee will consider candidates for director who have the skills, experiences (whether in business or in other areas such as public service or academia), particular areas of expertise, and other characteristics to enable them to best contribute to the success of the Company. Director nominees should possess the highest personal and professional ethics, integrity and values and must be committed to representing the long-term interests of shareholders. Additionally, director nominees should have sufficient time to effectively carry out their duties.

Biographical information concerning the directors and the nominees for election to the Board of Directors, and the specific experience, qualifications, attributes and skills that led to the conclusion of the Governance Committee and the Board of Directors that the person should serve as a director, is presented below. Except as otherwise indicated, each of these persons has had the same principal position and employment for over five years.

Nominees for Director with Terms Expiring in 2015

Ronald L. Haan, age 58, has been a director of the Company and the Bank since 2009. Mr. Haan is Chief Executive Officer and President of the Company and the Bank. Mr. Haan served as Executive Vice President of Macatawa Bank from September 2005 until August 12, 2009. Mr. Haan was appointed as a director and Co-Chief Executive Officer, Secretary and Treasurer of the Company on February 9, 2009. In August 2009, Mr. Haan was appointed Chief Executive Officer and President of the Company and the Bank. Prior to September 2005, Mr. Haan was employed as an Executive Vice President of Fifth Third Bank. Mr. Haan also served as the President and Chief Operating Officer of Ottawa Financial Corporation and AmeriBank, a position held since 1989. Mr. Haan served as a Director of Ottawa Financial Corporation, and AmeriBank. He has been in banking since 1975 working in various capacities. In addition to banking experience, he has also served in his community by serving as a director of Pine Rest Christian Mental Health, the Barnabas Foundation, Grand Rapids Christian School Association and CRC Loan Fund, Inc. In nominating Mr. Haan, the Governance Committee considered as important factors his extensive banking experience, his service to and familiarity with the Company, his experience working in public companies, his familiarity with and ability to understand financial statements, and his community involvement.

Douglas B. Padnos, age 57, has been a director of the Company since 2009 and a director of the Bank since 2007. Mr. Padnos has been a leader in our business community for many years. After 12 years in sales and sales management in the residential and contract furniture industry, he joined his family business, Louis Padnos Iron & Metal, where he has served as Executive Manager of the Paper and Plastics division since 1989. He has also served as President of the Holland Area Arts Council, VP and Trustee of the Grand Rapids Art Museum and has supported other not for profit organizations including the Boys & Girls Club and Hospice of Holland. Mr. Padnos is a 1977 graduate of the University of Michigan. In nominating Mr. Padnos, the Governance Committee considered as important factors his extensive business experience, his familiarity with the markets in which we operate, his familiarity with and ability to understand financial statements, and his extensive work for not for profit organizations.

Richard L. Postma, age 61, has been a director of the Company and the Bank since 2009. Mr. Postma is Chairman of the Board of the Company. Mr. Postma was selected by the Board of Directors in the fall of 2009 to serve as a director and Chairman because of his stature as a successful and respected business leader in West Michigan. Mr. Postma is Chief Executive Officer and co-founder of U.S. Signal, the Midwest's largest fiber optic carrier network. He currently serves on the Board of Directors of AboveNet Inc. (NYSE: ABVT), where he is a member of the Audit Committee, Compensation Committee, and Strategy Committee. He also holds several leadership positions with a variety of other companies, serving as Chairman of TurnKey Network Solutions, LLC, a telecommunications contractor focused on infrastructure solutions, R.T. London, Inc., a designer and manufacturer of high-quality durable furniture, and P&V Capital Holdings, L.L.C. He has also served as Co-Chairman and CEO of U.S. Xchange, LLC and has previously served on the Board of Directors and the Audit Committee of Choice One Communications, Inc. Since joining our Company, Mr. Postma has been working very closely with other directors and the Bank's leadership team to provide strategic direction, improve shareholder value and return the Company to profitability. In nominating Mr. Postma, the Governance Committee considered as important factors his extensive business experience, his reputation as a respected business leader in our community, his experience working with public companies, his familiarity with and ability to understand financial statements, and his extensive community involvement. Although Mr. Postma initially agreed to join the Company temporarily to direct its turnaround, he has agreed to remain in his current capacity for the duration of the proposed 3 year term expiring in 2015.

Directors with Terms Expiring in 2014

Mark J. Bugge, age 43, has been a director of the Company and the Bank since 2008. Mr. Bugge is the CFO of VA Enterprises, LLC (VAE), located in Grand Rapids, Michigan, the office representing the Van Andel family. The core holding for the family is Amway Corporation which was co-founded by the late Jay Van Andel. Mr. Bugge graduated from Central Michigan University and earned an M.B.A. from Davenport University. He worked for Amway in a variety of finance positions from 1992 through 2000. Since 2000, Mr. Bugge's responsibilities and experience includes oversight of internal and external staff, finance, risk management, human resources and portfolio investments. He also serves as the family liaison with Amway. Mr. Bugge was designated by White Bay Capital, LLC as a director of the Company pursuant to a Board Representation Agreement.

On November 5, 2008, the Company entered into a Board Representation Agreement with White Bay Capital, LLC, a Michigan limited liability company. On November 5, 2008, White Bay Capital purchased 20,000 shares of Series A Preferred Stock. Under the Board Representation Agreement, the Corporation agreed to take all necessary action to cause one person designated by White Bay Capital to be elected to the Company's Board of Directors for so long as White Bay Capital continues to own shares of preferred and common stock that represent at least 3.0% of the outstanding voting shares of capital stock of the Company. Mr. Bugge is the director designated by White Bay Capital.

Birgit M. Klohs, age 60, has been a director of the Company since September 2010 and a director of the Bank since 2003. Ms. Klohs is President & Chief Executive Officer of The Right Place, Inc., located in Grand Rapids. The Right Place, Inc., is the regional economic development organization for the retention, expansion and attraction of businesses to the West Michigan Area. Ms. Klohs also serves on the Spectrum Health Systems and ADAC Automotive boards. She is also involved with the Michigan Economic Development Corporation, Grand Action Executive Committee and Kent County/Grand Rapids Convention and Arena Authority, and chairs the Local Development Finance Authority. In nominating Ms. Klohs, the Governance Committee considered as important factors her extensive business experience, her extensive work in working to promote economic development in West Michigan, her familiarity with the markets in which we operate, her familiarity with and ability to understand financial statements, and her extensive work for not for profit organizations.

Arend D. Lubbers, age 80, has been a director of the Company and the Bank since 2003. Mr. Lubbers is an independent consultant and previously served as the President of Grand Valley State University from 1969 to 2001. Mr. Lubbers served as a director of Grand Bank Financial Corporation and Grand Bank from 1990 to 2002. Mr. Lubbers is a graduate of Hope College and received his graduate degree from Rutgers University. In nominating Mr. Lubbers, the Nominating Committee considered as important factors his service to and familiarity with the Company and the Bank, his historical experience as a director of Grand Bank, his familiarity with and ability to understand financial statements, and his professional and educational expertise in our communities.

Thomas P. Rosenbach, age 55, has been a director of the Company and the Bank since October 2010. Mr. Rosenbach has been a Partner with Beene Garter LLP since 1990 and he currently serves as Managing Partner of the firm. He brings over 28 years of experience in public accounting, specializing in construction, real estate, manufacturing and wholesale distribution industries. Mr. Rosenbach is a member of the American Institute of Certified Public Accountants, the Michigan Association of Certified Public Accountants and the Construction Financial Managers Association. He is active in the West Michigan community having served on the Pine Rest Christian Hospital Board and is active with the Associated Builders and Contractors of West Michigan. In nominating Mr. Rosenbach, the Governance Committee considered as important factors his extensive accounting and finance experience, his ability to understand financial statements and qualify as an "audit committee financial expert," his experience working with public companies, his reputation as a respected business leader in our community, and his extensive community involvement.

Directors with Terms Expiring in 2013

Wayne J. Elhart, age 57, has been a director of the Company since September 2010 and a director of the Bank since 1998. Mr. Elhart graduated from Northwood University in 1976 with degrees in marketing, advertising and accounting and has been involved in the management of the Elhart family automotive dealerships in Holland since 1980 and president of Elhart Holdings since 1990. Mr. Elhart has been involved in the automobile industry for over 44 years in various capacities. Over his career, he has served on many boards and committees with automobile manufacturers as well as outside of the automotive industry. Mr. Elhart served as President of the National Dealer Counsel for General Motors and as a board member of the West Michigan Better Business Bureau. In nominating Mr. Elhart, the Governance Committee considered as important factors his extensive business experience, his familiarity with the markets in which we operate, and his familiarity with and ability to understand financial statements.

Charles A. Geenen, age 53, has been a director of the Company since September 2010 and a director of the Bank since 2008. Mr. Geenen has been President of GDK Construction Co., Inc., in Holland since 1983 and is associated with Geenen DeKock Properties LLC, a commercial real estate development company. Mr. Geenen is a licensed builder and licensed real estate sales professional. Mr. Geenen has previously served on the City of Holland Downtown Development Authority and City of Holland Building Board of Appeals. He currently serves on the Trinity Christian College Board of Trustees. In nominating Mr. Geenen, the Governance Committee considered as important factors his extensive business experience, his familiarity with the markets in which we operate, his familiarity with and ability to understand financial statements, and his extensive work for municipal and not for profit organizations.

Robert L. Herr, age 66, has been a director of the Company and the Bank since October 2010. Mr. Herr, a former Partner with Crowe Horwath LLP, retired in 2007 after 40 years with the firm. He has worked with private and public clients across many business sectors. Mr. Herr spent over 15 years as a member of the firm's financial institutions practice and his experience includes extensive regulatory interaction and knowledge of publicly traded bank holding companies. In addition to his client work, Mr. Herr served for 6 years on the firm's executive committee and was the chair of the firm’s Audit Committee for 2 years. Mr. Herr also serves on the board and audit committee of Thornapple Capital, Inc., a company formed as a Capital Pool Company under the policies of the Toronto TSX Venture Exchange. He is also on the board of Progressive AE, a West Michigan based architectural and engineering firm. Mr. Herr is active in the West Michigan community serving as Board Chair of the Downtown Improvement District. He is a Board Member of the Advantage Health/St. Mary’s Medical Group, Economic Club of Grand Rapids, Jandernoa Entrepreneurial Mentoring, First Steps Commission, Downtown Alliance, Blue Cross/Blue Shield West Michigan Business Advisory Board, Michigan Catholic Conference Pension Board, and Western Michigan University Foundation. In 2009, Mr. Herr was the initial inductee into the Academy of Outstanding Alumni of the Department of Accountancy at Western Michigan University. In nominating Mr. Herr, the Governance Committee considered as important factors his extensive accounting and finance experience, his ability to understand financial statements and qualify as an "audit committee financial expert," his experience working with public companies, in particular his work with public financial institutions, his reputation as a respected business leader in our community, and his extensive community involvement.

Thomas J. Wesholski, age 66, has been a director of the Company since 2009 and a director of the Bank since 2004. Mr. Wesholski is a long time banker, joining the Company in 2002 with our acquisition of Grand Bank. From 2002 to 2004 he served as Executive Vice President of Macatawa Bank, responsible for development and growth of our bank franchise in Kent County. He served as President, Chairman and CEO of Grand Bank, working there from 1997 until 2002. Prior to joining Grand Bank, Mr. Wesholski was a Senior Vice President in various corporate positions with First Michigan Bank Corporation from 1988 to 1997 with responsibilities in West Michigan. He served in various senior level positions at Michigan National Bank in Grand Rapids from 1967 to 1988, including President of Michigan National Bank – Central from 1985 to 1988. He is also very active serving various community organizations. He has served as a director or trustee for Mary Free Bed Rehabilitation Hospital, Priority Health, Grand Rapids Building Authority, Grand Rapids Downtown Development Authority, Grand Rapids Chamber of Commerce, Peninsular Club, as well as many others. In nominating Mr. Wesholski, the Governance Committee considered as important factors his extensive banking experience, his service to and familiarity with the Company, his familiarity with and ability to understand financial statements, his historical experience with Grand Bank, and his extensive community involvement.

Board Committees

Macatawa's Board of Directors has three standing committees:

The table below shows each person currently serving as a director, whether the person is an independent director and each committee on which the person serves.

|

Director

|

Independent

Director(1)

|

Audit

Committee

|

Compensation

Committee

|

Governance

Committee

|

|

Mark J. Bugge

|

Yes

|

Member

|

|

Member

|

|

Wayne J. Elhart

|

Yes

|

|

Member

|

Member

|

|

Charles A. Geenen

|

Yes

|

|

Member

|

|

|

Robert L. Herr

|

Yes

|

Member

|

Member

|

|

|

Ronald L. Haan

|

No

|

|

|

|

|

Birgit M. Klohs

|

Yes

|

|

|

Member

|

|

Arend D. Lubbers

|

Yes

|

Member

|

|

Member

|

|

Douglas B. Padnos

|

Yes

|

|

Member

|

Member

|

|

Richard L. Postma

|

Yes

|

Member

|

Member

|

Member

|

|

Thomas P. Rosenbach

|

Yes

|

Member

|

Member

|

Member

|

|

Thomas J. Wesholski

|

Yes

|

Member

|

|

|

|

(1)

|

Independent as that term is defined in NASDAQ Listing Rules for service on the Board of Directors and each committee on which the director serves.

|

Audit Committee

The Board of Directors has established the Audit Committee to assist the Board in fulfilling its fiduciary responsibilities with respect to accounting, auditing, financial reporting, internal control, and legal compliance. The Audit Committee oversees management and the independent auditors in the Company's accounting and financial reporting processes and audits of the Company's financial statements. The Audit Committee serves as a focal point for communication among the Board, the independent auditors, the internal auditor and management with regard to accounting, reporting, and internal controls. Mr. Bugge serves as the Chairman of the Audit Committee. During 2011, the Audit Committee met 18 times.

The Audit Committee represents the Board of Directors in oversight of:

| |

●

|

the integrity of the financial reports and other financial information disclosed by the Company;

|

| |

●

|

the Company's systems of disclosure controls and procedures and internal controls over financial reporting;

|

| |

●

|

legal compliance and the establishment of a code of ethics;

|

| |

●

|

independence and performance of the Company's independent auditors (who are ultimately responsible to the Board of Directors and the Audit Committee);

|

| |

●

|

the Company's auditing, accounting and financial reporting processes generally;

|

| |

●

|

the Bank's risk management and loan review functions; and

|

| |

●

|

compliance with orders, agreements, understandings, resolutions or similar commitments or with regulatory agencies with authority over the Company or the Bank.

|

The Audit Committee must be composed of three or more directors appointed by the Board of Directors, one of whom must be designated by the Board of Directors as the Chair. Each member of the Audit Committee must be independent of the management of the Company and free of any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as an Audit Committee member. Each member of the Audit Committee must be an "independent director" as defined by Nasdaq Listing Rules and as required under rules and regulations of the Securities and Exchange Commission. A director may not be a member of the Audit Committee if he or she participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years. Each member of the Audit Committee must be able to read and understand fundamental financial statements, including the Company's balance sheet, income statement, and cash flow statement.

At least one member of the Audit Committee must be a person whom the Board has determined has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication and is an "audit committee financial expert" as that term is defined by applicable regulations of the Securities and Exchange Commission. The Board of Directors has determined that Messrs. Herr and Rosenbach are each an "audit committee financial expert" under rules and regulations of the Securities and Exchange Commission.

The Audit Committee operates under a charter adopted by the Board of Directors. A copy of the Audit Committee Charter is available in the "Investor Relations – Governance Documents" section of our website, www.macatawabank.com.

Compensation Committee

The Compensation Committee assists the Board of Directors in fulfilling its responsibilities relating to compensation of the Company's executive officers and the Company's compensation and benefit programs and policies. The Compensation Committee has full power and authority to perform the responsibilities of a public company compensation committee under applicable law, regulations, stock exchange rules and public company custom and practice. The Compensation Committee may establish subcommittees of the committee and delegate authority and responsibility to subcommittees or any individual member of the committee. Mr. Postma serves as the Chairman of the Compensation Committee. The Compensation Committee did not meet during 2011.

The Compensation Committee must be composed of three or more directors appointed by the Board of Directors, one of whom must be designated by the Board of Directors as the Chair. Each member of the Compensation Committee must be independent of the management of the Company and free of any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as a Compensation Committee member. Each member of the Compensation Committee must be an "independent director" as defined by Nasdaq Listing Rules. In addition, each member of the Compensation Committee must be a "non-employee director" as defined by Securities and Exchange Commission Rule 16b-3, and an "outside director" as defined by Internal Revenue Service Regulation 1.162-27. Each member of the Compensation Committee must be free of any "compensation committee interlock" that would require disclosure by the Company under Securities and Exchange Commission Regulation S-K, Item 407.

The Compensation Committee operates under a charter adopted by the Board of Directors. A copy of the Compensation Committee Charter is available in the "Investor Relations – Governance Documents" section of our website, www.macatawabank.com.

Governance Committee

The Governance Committee assists the Board of Directors in fulfilling its responsibilities by providing independent director oversight of nominations for election to the Board of Directors and leadership in the Company's corporate governance. The Governance Committee has full power and authority to perform the responsibilities of a public company nominating and governance committee under applicable law, regulations, stock exchange rules and public company custom and practice. The Governance Committee may establish subcommittees of the committee and delegate authority and responsibility to subcommittees or any individual member of the committee. Mr. Postma serves as the Chairman of the Governance Committee. During 2011, the Governance Committee met one time.

The Governance Committee must be composed of three or more directors appointed by the Board of Directors, one of whom must be designated by the Board of Directors as the Chair. Each member of the Governance Committee must be independent of the management of the Company and free of any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as a Governance Committee member. Each member of the Governance Committee must be an "independent director" as defined by Nasdaq Listing Rules.

The Governance Committee operates pursuant to the Governance Committee Charter, a copy of which is available at the Company's website, www.macatawabank.com, under the "Investor Relations – Governance Documents" section.

Corporate Governance

Corporate Governance Policy

As part if its continuing efforts to improve corporate governance, the Board of Directors has adopted a comprehensive Corporate Governance Policy. The policy is designed to promote accountability and transparency for the Board of Directors and management of the Company. The policy contains guidelines regarding the responsibilities, membership, and structure of the Board of Directors, including policies addressing:

|

|

·

|

Director independence, diversity, education, and conflicts of interest; and

|

|

|

·

|

Majority vote requirement for uncontested elections

|

The policy also contains guidelines for other significant corporate governance matters, such as the Board of Directors' responsibility for risk management and succession planning. The Corporate Governance Policy is available at the Company's website, www.macatawabank.com, under the "Investor Relations – Governance Documents" section.

Meetings of the Board of Directors

The Company's Board of Directors had 19 meetings in 2011. All directors attended at least 75% of the aggregate number of meetings of the Board and Board committees in which they were eligible to attend. The Company encourages members of its Board of Directors to attend the annual meeting of shareholders. All but one of the directors serving at May 10, 2011, attended the Company's 2011 annual meeting held on that date.

Meetings of Independent Directors

The Company's independent directors meet periodically in executive sessions without any management directors in attendance. If the Board of Directors convenes a special meeting, the independent directors may hold an executive session if the circumstances warrant.

Director Nominations

The Governance Committee is responsible for identifying and recommending qualified individuals to serve as members of the Company's Board of Directors. The Governance Committee has not established specific, minimum qualifications for director nominees. The Governance Committee will consider candidates for director who have the skills, experiences (whether in business or in other areas such as public service or academia), particular areas of expertise, and other characteristics to enable them to best contribute to the success of the Company. Director nominees should possess the highest personal and professional ethics, integrity and values and must be committed to representing the long-term interests of shareholders. Additionally, director nominees should have sufficient time to effectively carry out their duties. The Governance Committee considers candidates based on their experience and expertise as well as demographics to appropriately reflect the diversity and makeup of our community and shareholders.

Shareholders may propose nominees for consideration by submitting the names, appropriate biographical information and qualifications in writing to: Jon W. Swets, Secretary, Macatawa Bank Corporation, 10753 Macatawa Drive, Holland, MI 49424-3119. In considering any nominee proposed by a shareholder, the Governance Committee will consider each individual and will reach a conclusion based on the criteria described above. After full consideration, the shareholder proponent will be notified of the decision concerning each nominee.

The Company's Articles of Incorporation contain certain procedural requirements applicable to shareholder nominations of directors. Shareholders may nominate a person to serve as a director if they provide written notice to the Company not later than sixty nor more than ninety days prior to the first anniversary date of the preceding year's annual meeting, in the case of an annual meeting, and not later than the close of business on the tenth day following the date on which notice of the meeting was first mailed to shareholders, in the case of a special meeting. The notice must include (1) the name and address of the shareholder who intends to make the nomination and of the person or persons nominated, (2) a representation that the shareholder is a current record holder of stock entitled to vote at the meeting and will continue to hold those shares through the date of the meeting and intends to appear in person or by proxy at the meeting, (3) a description of all arrangements between the shareholder and each nominee and any other person pursuant to which the nomination is to be made by the shareholder, (4) the information regarding each nominee as would be required to be included in a proxy statement filed under Regulation 14A of the Securities Exchange Act of 1934 had the nominee been nominated by the Board of Directors, and (5) the consent of each nominee to serve as a director.

The Board of Directors and Governance Committee do not currently use the services of any third party search firm to assist in the identification or evaluation of board member candidates. However, the Governance Committee has the authority to use such a firm in the future if it deems necessary or appropriate.

Leadership Structure

In 2010, we implemented changes to promote the independence and objectivity of the Board of Directors. Five new, independent directors were appointed to the Company's Board of Directors that we believe strengthened the experience, skills, objectivity and independence of the Board. The Boards of Directors of the Company and the Bank were consolidated, so that shareholders of the Company will in the future effectively elect all persons who serve on the Bank's Board of Directors.

Currently, the Company's Chairman of the Board and Chief Executive Officer are separate positions in recognition of the difference between the two roles. The Chairman of the Board leads the Board of directors in adopting an overall strategic plan for the Company, sets the agenda for the meetings of the Board of Directors, presides over all meetings of the Board of Directors, and provides guidance to the Chief Executive Officer. The Chief Executive Officer implements the strategic plan for the Company as adopted by the Board of Directors and leads the Company, its management and its employees on a day-to-day basis. Because of these differences, the Company currently believes keeping the Chairman of the Board and Chief Executive Officer as separate positions is the appropriate leadership structure for the Company.

Oversight of Risk Management

The Company is exposed to a variety of risks and undertakes at least annually an enterprise risk management review to identify and evaluate these risks and to develop plans to manage them effectively. During 2011, the Bank's enterprise risk management responsibilities were managed by the Chief Financial Officer, Chief Credit Officer and the Director of Risk Management.

The Board of Directors, and the Audit Committee under authority and responsibility delegated by the Board of Directors, play a key role in the oversight of the Company's risk management. To that end, the Board of Directors or the Audit Committee must periodically require and receive direct reports from the persons holding the following positions (which may be combined):

|

|

·

|

Director of Risk Management

|

|

|

·

|

Senior Manager of the Loan Review Function

|

The Audit Committee, which is composed entirely of independent directors, has authority and responsibility to oversee the Company's internal audit function, and the risk management and loan review functions of the Bank. Specifically, the Committee has the authority and responsibility to:

|

|

·

|

Oversee each function, including its personnel, resources, organizational structure, and relationship to the Company's overall business objectives.

|

|

|

·

|

Review the independence of the officers responsible for each function.

|

|

|

·

|

Inquire into whether the officers responsible for each function have sufficient authority, support, resources, and the necessary access to Company personnel, facilities and records to carry out their work.

|

|

|

·

|

Review reports of significant findings and recommendations and management's corrective action plans.

|

|

|

·

|

Establish and maintain channels for the officers responsible for each function to communicate directly with the Committee.

|

|

|

·

|

Review the performance of the officers responsible for each function.

|

The Chief Financial Officer, Chief Credit Officer and Director of Risk Management meet with the Audit Committee on a monthly basis to discuss the risks facing Macatawa, and highlight any new risks that may have arisen since they last met.

The Company has appointed the Director of Risk Management as the key individual within the Company responsible for independent oversight of the Risk Management process, with direct functional and administrative reporting to the Audit Committee. The Director of Risk Management meets monthly with the Audit Committee and attends all Board of Directors meetings to discuss the risks facing Macatawa. The Director of Risk Management works closely with members of senior management, including the President and Chief Executive Officer, Chief Financial Officer, Chief Credit Officer, Head of Business Banking, Senior Retail Banking Officer, Chief Information Officer, Director of Human Resources, outside legal counsel, and others.

Our Special Assets Group (SAG) is headed by individuals with significant commercial lending and workout experience to monitor all adversely graded loans. SAG reports directly to the Audit Committee.

The Chief Financial Officer, Chief Credit Officer, Head of Business Banking and Director of Risk Management attend all regular, monthly meetings of the Board of Directors and report on credit metrics and risks facing the Bank.

The Loan Review function reports functionally to the Audit Committee and administratively to the Director of Risk Management.

Majority Voting

The Board believes that the Company and its shareholders are best served by having directors who enjoy the confidence of the Company's shareholders. If any director receives a greater number of votes "withheld" than votes "for" election in an uncontested election at an annual meeting of shareholders (a "Majority Withheld Vote"), then the Board will presume that such director does not have the full confidence of the shareholders. A director receiving a Majority Withheld Vote must promptly offer his or her resignation from the Board to the Governance Committee upon certification of the shareholder vote. The resignation will be effective if and when accepted by the Governance Committee.

The Governance Committee, which consists entirely of independent directors, will promptly consider the acceptance of the director's offer of resignation. The director at issue will not participate in the consideration of or the vote on the offer of resignation.

The Governance Committee is expected to consider and vote upon acceptance or rejection of the offer of resignation in its sole discretion not later than the day of the next regularly scheduled meeting of the Board, which is held more than one week after the annual meeting of shareholders. The Governance Committee is expected to evaluate whether or not the Majority Withheld Vote represented a failure of confidence in the director by the shareholders. Examples of reasons why the Governance Committee may decline to accept a resignation include, but are not limited to, a conclusion that votes were withheld because of an identifiable cause that has subsequently been adequately addressed or a belief that the Majority Withheld Vote is attributable to technical issues or deficiencies in the proxy solicitation process.

The Company will disclose the Governance Committee's decision regarding the director’s offer of resignation (and the reasons for rejecting the resignation offer, if applicable) in an appropriate filing with the Securities and Exchange Commission.

Term Limits

The Company does not have predetermined term limits for directors. The Governance Committee will evaluate each director's continued services on the Board annually. In connection with each nomination for re-election, each director will have an opportunity to confirm his or her desire to continue as a member of the Board.

Retirement

The Board of Directors believes that it is generally appropriate for directors to retire before the age of 70. A director will not ordinarily be nominated for re-election to the Board of Directors following the expiration of the term of office which ends after his or her 70th birthday. The Board of Directors recognizes, however, that the wisdom, experience and contribution of a director aged 70 years or older could benefit the Board and the Governance Committee may, in its discretion, nominate a director for re-election after his or her 70th birthday.

Change in Employment or Independence

Directors recognize that they have been chosen for nomination or appointment to the Board of Directors in part because of the knowledge and insight they gain on a continuing basis from their active employment in their current positions and for the public respect they bring to the Company and its Board of Directors because of the positions they hold in the business community. A director who experiences a material change in his or her employment status must inform the Governance Committee as soon as practicable and is expected to promptly offer his or her resignation as a director to the Governance Committee. The Governance Committee will consider and vote upon acceptance or rejection of the director's offer in its sole discretion, excluding the affected director from consideration of and voting on acceptance of the resignation.

An independent director who ceases to be an independent director under NASDAQ Listing Rules for any reason must inform the Governance Committee as soon as practicable and is expected to promptly offer his or her resignation as a director to the Governance Committee. The Governance Committee will consider and vote upon acceptance or rejection of the director's offer in its sole discretion, excluding the affected director from consideration of and voting on acceptance of the resignation.

Other Board Memberships

Each executive officer of the Company must notify the Governance Committee before serving as a member of the board of directors of any other business organization. The Governance Committee will review executive officers' membership on external boards of directors at least annually. The Governance Committee may limit the directorships for any executive officer if it believes that they will interfere with the executive officer's responsibilities to the Company.

Security Holder Communication with Directors

The Company must provide a process for security holders to send communications to the Board of Directors. Such communications should be directed to the Secretary of the Company. The Secretary of the Company, or the Secretary's delegates, have discretion to adopt policies and procedures to implement and administer this communication process. Security holder communications may be directed to the Board of Directors, a committee of the Board of Directors or to specific individual directors. The Secretary has discretion to screen and not forward to directors, communications which the Secretary determines in his or her discretion to be communications unrelated to the business or governance of the Company and its subsidiaries, commercial solicitations, offensive, obscene or otherwise inappropriate. The Secretary must, however, collect and organize all security holder communications which are not forwarded, and such communications must be available to any director upon request.

Security holders may communicate with members of the Company's Board of Directors by mail addressed to the full Board of Directors, to a specific member or to a particular committee of the Board of Directors at Macatawa Bank Corporation, 10753 Macatawa Drive, Holland, Michigan 49424.

External Communications

The Board believes that the Chairman of the Board and management of the Company should speak for the Company. Individual Board members who are not the Chairman of the Board or officers should not communicate with outside parties regarding corporate matters unless authorized by the Board, the Chairman of the Board or management. If so authorized, Board members may communicate with various constituencies that are involved with the Company, subject to applicable law and the Company's policies regarding the disclosure of information.

Code of Ethics

As part of its continuing efforts to improve corporate governance, in 2011 the Board of Directors adopted a new and comprehensive Code of Ethics. The code is intended to deter wrongdoing and to promote:

|

|

·

|

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

|

|

|

·

|

Full, fair, accurate, timely and understandable disclosure in documents the Company files with, or submits to, the SEC and in all public communications made by the Company;

|

|

|

·

|

Compliance with applicable governmental laws, rules and regulations; and

|

|

|

·

|

Prompt internal reporting to designated persons of violations of the code.

|

The Code of Ethics is available upon request by writing to the Chief Financial Officer, Macatawa Bank Corporation, 10753 Macatawa Drive, Holland, Michigan 49424 and is also available on the Company's website, www.macatawabank.com, under the "Investor Relations – Governance Documents" section.

Problem Resolution Policy

The Company strongly encourages employees to raise possible ethical issues. We maintain a problem resolution hotline to receive reports of ethical concerns or incidents, including, without limitation, concerns about accounting, internal controls or auditing matters. Users of the hotline may choose to remain anonymous. We prohibit retaliatory action against any individual for raising legitimate concerns or questions, or for reporting suspected violations.

Board Diversity

The Board believes that the Company and its shareholders are best served by having a Board of Directors that brings a diversity of education, experience, skills, and perspective to Board meetings. The Governance Committee and the Board of Directors will consider such diversity in identifying director nominees. There are no specific or minimum qualifications or criteria for nomination for election or appointment to the Board.

Independent Auditors

Fees

The aggregate fees billed or to be billed by the Company's independent auditors to Macatawa and its subsidiaries for 2011 and 2010 were as follows:

| |

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

Audit Fees(1)

|

|

$ |

208,906 |

|

|

$ |

171,756 |

|

|

Audit-Related Fees(2)

|

|

|

0 |

|

|

|

0 |

|

|

Tax Fees(3)

|

|

|

29,470 |

|

|

|

15,000 |

|

|

All Other Fees(4)

|

|

|

0 |

|

|

|

0 |

|

|

(1)

|

Audit services consist of the annual audit of the financial statements and internal control over financial reporting, reviews of quarterly reports on Form 10-Q, and related consultations, including the review of SEC Form S-1 registration statement for the Company’s public stock offering in 2011.

|

|

(2)

|

Audit-related services consist principally of services related to accounting matters not arising as part of the audit.

|

|

(3)

|

Permissible tax services include tax compliance, tax planning and tax advice that do not impair the independence of the auditors and that are consistent with the SEC's rules on auditor independence. Tax compliance and preparation fees account for $16,174 and $15,000 of the total tax fees for 2011 and 2010, respectively. Tax fees for 2011 also include consultation under Section 382 of the Internal Revenue Code related to the Company’s public stock offering in 2011.

|

|

(4)

|

Includes other permitted consulting services.

|

Audit Committee Approval Policies

The Audit Committee has direct authority and responsibility to pre-approve all audit and permissible non-audit services provided to the Company by the Company's independent auditors. In accordance with this authority and responsibility, the Audit Committee pre-approved all services performed by the Company’s independent auditors during 2010 and 2011.

All pre-approvals of audit and permissible non-audit services granted by the Audit Committee must be reasonably detailed as to the particular services to be provided and must not result in the delegation of the Audit Committee's pre-approval responsibilities to management. Pre-approvals of services granted by the Audit Committee must not use monetary limits as the only basis for pre-approval and must not provide for broad categorical approvals. Any pre-approval policies or practices adopted by the Audit Committee must be designed to ensure that the Audit Committee knows what particular services it is being asked to pre-approve so that it can make a well-reasoned assessment of the impact of the service on the independent auditors' independence.

The Audit Committee may delegate to one or more designated members of the committee the authority to grant pre-approvals of permissible non-audit services. The decisions of any member to whom this authority is delegated must be reported to the full Audit Committee.

Non-audit services provided by the Company's independent auditors must not include any of the following:

|

|

·

|

Bookkeeping or other services related to the accounting records or financial statements of the Company;

|

|

|

·

|

Financial information systems design and implementation;

|

|

|

·

|

Appraisal or valuation services, fairness opinions, or contribution-in-kind reports;

|

|

|

·

|

Internal audit outsourcing services;

|

|

|

·

|

Management functions or human resources;

|

|

|

·

|

Broker-dealer, investment adviser, or investment banking services;

|

|

|

·

|

Legal services and expert services unrelated to the audit; and

|

|

|

·

|

Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible.

|

Appointment of Independent Auditor

The Audit Committee has direct authority and responsibility for the appointment, compensation, retention and oversight of the work of any accounting firm engaged for the purpose of issuing an audit report and performing other audit, review or attestation services for the Company. The Audit Committee is also directly responsible for the resolution of disagreements between management and the independent auditors regarding financial reporting. Independent auditors report directly to the Audit Committee.

The Audit Committee must review the performance of the independent auditors of the Company at least annually. The Audit Committee must review the independence, effectiveness and objectivity of the independent auditors of the Company at least annually.

The Audit Committee has direct authority and responsibility to oversee the independence of the independent auditors. The Audit Committee must require receipt of, and must review, a formal written statement of the independent auditors delineating all relationships between the independent auditor and the Company, consistent with the standards of the Public Company Accounting Oversight Board. The Audit Committee must discuss with the independent auditor the independent auditor's independence, including a discussion of any disclosed relationships or services that may impact the objectivity and independence of the independent auditor. If the Audit Committee is not satisfied with the independent auditors' assurances of independence, it must take or recommend to the full Board of Directors appropriate action to ensure the independence of the independent auditors.

The Audit Committee must discuss with the independent auditors the matters required to be discussed by applicable legal, regulatory, and stock exchange listing rule requirements relating to the conduct of the audit and any qualifications in the independent auditors' audit opinion.

The Audit Committee has appointed BDO USA, LLP to serve as the Company's independent registered public accounting firm for the year ending December 31, 2012. BDO USA, LLP also served as the Company's independent registered public accounting firm for the year ended December 31, 2011. Representatives of BDO USA, LLP are expected to be present at the annual meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders.

Changes in and Disagreements with Accountants

On May 18, 2010, the Company's Audit Committee selected and appointed BDO USA, LLP ("BDO") as the Company's independent registered public accounting firm for the fiscal year ended December 31, 2010. On May 20, 2010, the Company's Board of Directors ratified and approved the Audit Committee's selection and appointment of BDO as the Company's independent registered public accounting firm for the fiscal year ended December 31, 2010. The selection and appointment of BDO followed a request for proposals process conducted by the Company during 2009 and 2010. The selection and appointment of BDO was recommended and approved by the Company's Audit Committee, which is comprised entirely of independent directors.

Crowe Horwath LLP ("Crowe Horwath") served as the Company's independent auditors for the year ended December 31, 2009 and was engaged during 2010 for the limited purpose of performing a review of the unaudited quarterly financial statements included in the Company's Form 10-Q Quarterly Report for the quarter ended March 31, 2010. On May 18, 2010, the Company's Chief Financial Officer notified Crowe Horwath that the engagement of Crowe Horwath as the Company's independent auditors would not be renewed and that BDO had been selected and appointed as the Company's independent registered public accounting firm for the fiscal year ended December 31, 2010.

In connection with the audit of the Company's financial statements for the year ended December 31, 2009, two "disagreements" (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K issued under the Securities Exchange Act of 1934, and its related instructions) between the Company and Crowe Horwath occurred. The first disagreement related to the amount of the provision for loan losses for the fourth quarter of 2009. This disagreement was resolved to the satisfaction of Crowe Horwath.

The second disagreement related to the inclusion by Crowe Horwath of a going concern paragraph in its opinion on its audit of the Company's consolidated financial statements as of and for the year ended December 31, 2009. Our financial statements as of and for the year ended December 31, 2009 were prepared assuming that the Company would continue as a going concern. Due to our significant net losses in 2009 and 2008, the Bank being considered "adequately capitalized" at December 31, 2009, the Bank not being in compliance with the capital requirements of our regulatory consent order at December 31, 2009, and the Bank not being expected to be in compliance with the consent order by December 31, 2010 without an external capital infusion, Crowe Horwath expressed the opinion that these events raise substantial doubt about the Company's ability to continue as a going concern. Management respectfully disagreed with Crowe Horwath's opinion that there is substantial doubt versus uncertainty about Macatawa's ability to continue as a going concern.

The Audit Committee discussed the subject matter of the disagreements with Crowe Horwath. The Company has authorized Crowe Horwath to respond fully to the inquiries of BDO concerning the subject matter of the disagreements.

Significant improvements in our processes and our financial results and condition occurred during the year ended December 31, 2010. BDO has issued an unqualified report on its audit of our financial statements as of and for the year ended December 31, 2010, and did not include a paragraph in its report expressing substantial doubt about the Company's ability to continue as a going concern.

Other than the disagreements described above, during the two years ended December 31, 2009 and 2008 and through May 18, 2010, there were no other "disagreements" (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K issued under the Securities Exchange Act of 1934, and its related instructions) between the Company and Crowe Horwath on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of Crowe Horwath, would have caused Crowe Horwath to make reference to the subject matter of the disagreement in connection with its reports.

Crowe Horwath's reports on the Company's financial statements as of and for the years ended December 31, 2009 and December 31, 2008 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles, except for the going concern paragraph in its opinion on its audit of the Company's consolidated financial statements as of and for the year ended December 31, 2009 described above.

During the course of the audit procedures for 2009, Crowe Horwath identified certain deficiencies in the Company's credit administration practices and allowance for loan losses determination process. Crowe Horwath concluded that these control deficiencies constituted a "material weakness" in internal control over financial reporting at December 31, 2009. The Chief Executive Officer and Chief Financial Officer of the Company also concluded that the control deficiencies constituted a material weakness in internal control over financial reporting at December 31, 2009. The Company has authorized Crowe Horwath to respond fully to the inquiries of BDO concerning this matter.

The Chief Executive Officer and Chief Financial Officer of the Company have determined that the improved controls instituted in response to Crowe Horwath's conclusion that a material weakness in internal control over financial reporting existed at December 31, 2009 have sufficiently remediated the deficiencies identified by Crowe Horwath and have concluded that no material weakness in internal control over financial reporting existed at December 31, 2010. BDO has issued an unqualified report on its audit of our internal control over financial reporting as of December 31, 2010, which states that Macatawa Bank Corporation maintained, in all material respects, effective internal control over financial reporting as of December 31, 2010.

Other than the material weakness described above, during the two years ended December 31, 2009 and 2008 and through May 18, 2010, there were no "reportable events" (as that term is defined in Item 304(a)(1)(v) of Regulation S-K issued under the Securities Exchange Act of 1934, and its related instructions) between the Company and Crowe Horwath.

During the two years ended December 31, 2009 and 2008 and through May 18, 2010, the Company did not consult with BDO regarding the application of accounting principles to a specified transaction (either completed or proposed), the type of audit opinion that might be rendered on the Company's financial statements, or any matter that was the subject of a disagreement or reportable event.

The Company provided BDO and Crowe Horwath with a copy of the information disclosed in this proxy statement under the heading "Changes in and Disagreements with Accountants." The Company provided BDO and Crowe Horwath an opportunity to furnish to the Company, for inclusion in this proxy statement, with a brief statement of its views if it believes the information disclosed in this proxy statement under the heading "Changes in and Disagreements with Accountants" is incorrect or incomplete. BDO and Crowe Horwath declined to provide such a statement.

Audit Committee Report

The following is the report of the Audit Committee with respect to the Company's audited financial statements as of and for the year ended December 31, 2011. The information contained in this report shall not be deemed “soliciting material” or otherwise considered “filed” with the SEC, and such information shall not be incorporated by reference into any future filing under the Securities Act of 1933 (the "Securities Act") or the Securities Exchange Act of 1934 (the "Exchange Act") except to the extent that the Company specifically incorporates such information by reference in such filing.

The Audit Committee has reviewed, and discussed with management and the independent auditors, the Company's audited financial statements as of and for the year ended December 31, 2011, management's assessment of the effectiveness of the Company's internal controls over financial reporting, and the independent auditors' attestation report on the Company's internal controls over financial reporting. The Audit Committee has discussed with the independent auditors the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor's communications with the Audit Committee concerning independence, and has discussed with the independent auditors the independent auditors' independence. This included consideration of the compatibility of non-audit services with the auditors' independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2011 for filing with the Commission.

Management is responsible for the Company's financial reporting process, including its systems of internal control, and for the preparation of financial statements in accordance with generally accepted accounting principles. The Company's independent auditors are responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. It is not our duty or our responsibility to conduct auditing or accounting reviews or procedures, and therefore our discussions with management and the independent auditors do not assure that the financial statements are presented in accordance with generally accepted accounting principles. We have relied, without independent verification, on management's representation that the financial statements have been prepared in conformity with U.S. generally accepted accounting principles and on the representations of the independent auditors included in their report on the Company's financial statements.

|

Mark J. Bugge

|

Arend D. Lubbers

|