UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12

|

|

Macatawa Bank Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required.

|

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

| ☐ |

Fee paid previously with preliminary materials.

|

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form

or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

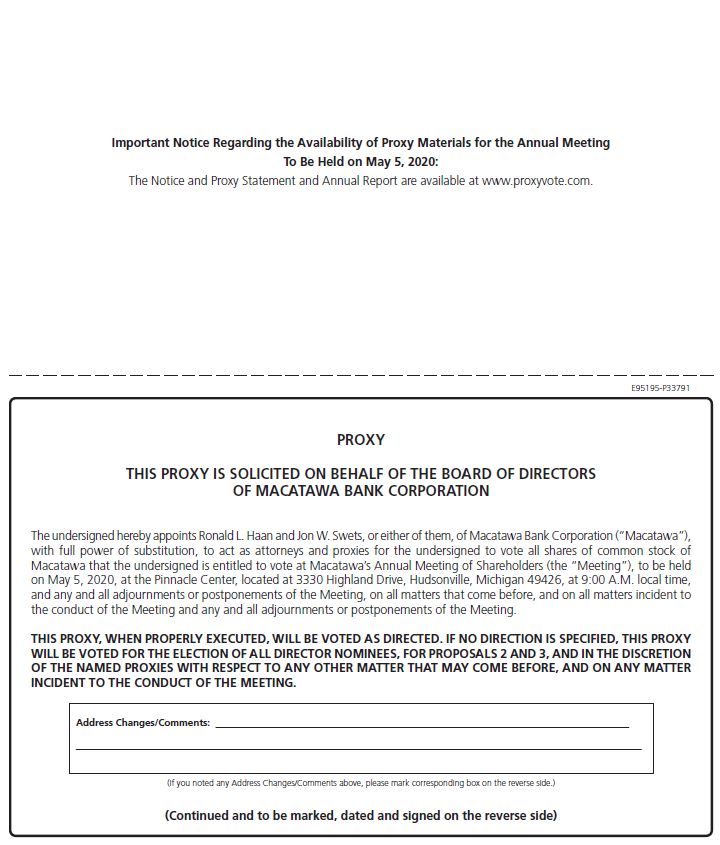

We intend to hold our annual meeting in person.

However, we are actively monitoring the coronavirus (COVID-19) outbreak; we are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal,

state, and local governments may impose. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the

meeting solely by means of remote communication.

Thank you for your understanding.

10753 Macatawa Drive

Holland, Michigan 49424

March 20, 2020

Dear Shareholder:

We cordially invite you to attend our 2020 annual meeting of shareholders. The meeting will be held on Tuesday, May 5, 2020, at 9:00 a.m. local time, at The Pinnacle Center, 3330 Highland Drive, Hudsonville,

Michigan 49426.

At the meeting, we will elect directors, vote on the advisory approval of executive compensation, ratify appointment of our independent auditors and conduct any other business that properly comes before the

meeting. We will also present a report on our business.

We have enclosed a notice of the meeting, proxy statement and proxy. The proxy statement includes information about the nominees for director, the proposals that will be voted on at the meeting, the different

methods you can use to vote your proxy, and other important information. Also enclosed is our annual report for the year ended December 31, 2019. You should read these documents carefully.

It is important that your shares be represented at the annual meeting, regardless of how many shares you own. Please sign, date and return the enclosed proxy as soon as possible, regardless of whether or not you

plan to attend the annual meeting. Voting your shares before the meeting will not affect your right to vote in person if you attend the meeting.

|

Sincerely,

|

|

|

|

|

Richard L. Postma

Chairman of the Board

|

|

Your vote is important. Even if you plan to attend the meeting,

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY.

|

MACATAWA BANK CORPORATION

10753 Macatawa Drive

Holland, Michigan 49424

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

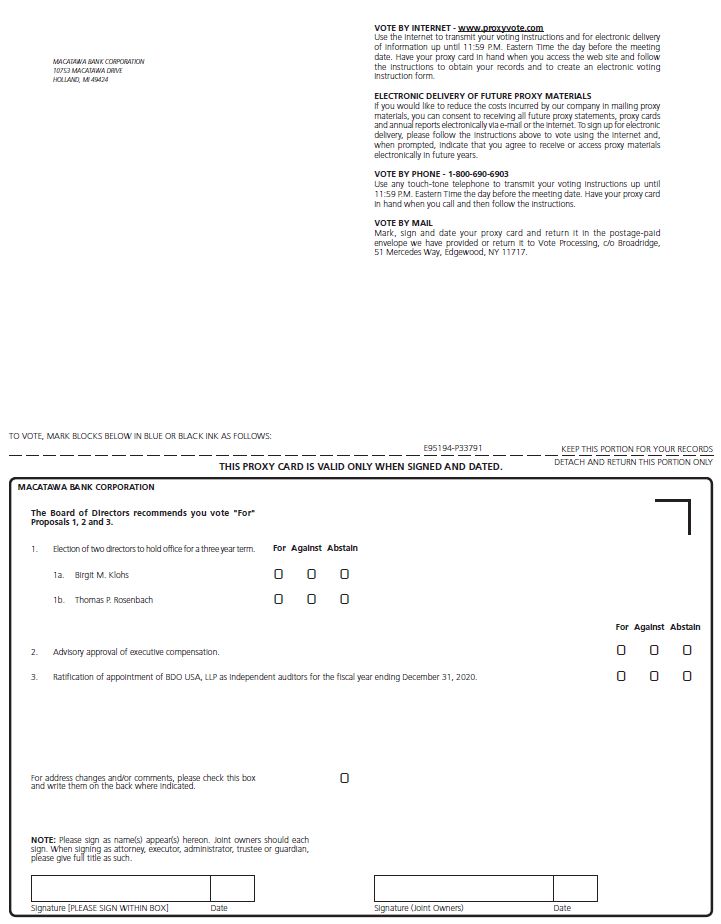

The 2020 annual meeting of shareholders of Macatawa Bank Corporation will be held at The Pinnacle Center, 3330 Highland Drive, Hudsonville, Michigan 49426, on Tuesday, May 5, 2020, at 9:00 a.m. local time. At the

meeting, we will consider and vote on:

| 1 |

Election of two directors to hold office for a three year term

|

| 2. |

Advisory approval of executive compensation

|

| 3. |

Ratification of appointment of BDO USA, LLP as independent auditors for the year ending December 31, 2020

|

We will also conduct any other business that properly comes before the meeting or at any adjournment of the meeting.

You are receiving this notice and can vote at the meeting and any adjournment of the meeting if you were a shareholder of record on March 9, 2020. The enclosed proxy statement is first being sent to our

shareholders on approximately March 20, 2020. A copy of our annual report for the year ended December 31, 2019 is enclosed with this notice.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on May 5, 2020: Our proxy statement and annual report for the year

ended December 31, 2019, which accompany this notice, are available for viewing, printing and downloading on the Internet at www.proxyvote.com or in the “Investor Relations” section of our website, www.macatawabank.com.

In addition, you may obtain free of charge electronic copies of all of our filings with the U.S. Securities and Exchange Commission from this section of our website.

BY ORDER OF THE BOARD OF DIRECTORS

Jon W. Swets

Secretary

March 20, 2020

|

Your vote is important. Even if you plan to attend the meeting,

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY.

|

MACATAWA BANK CORPORATION

PROXY STATEMENT

dated March 20, 2020

For the Annual Meeting of Shareholders

to be held May 5, 2020

|

Page

|

|

|

1

|

|

|

4

|

|

| 5 |

|

|

6

|

|

|

7

|

|

|

8

|

|

|

14

|

|

|

20

|

|

|

22

|

|

|

23

|

|

|

24

|

|

|

32

|

|

|

34

|

|

|

35

|

|

|

35

|

|

|

36

|

|

|

36

|

|

|

37

|

| A. |

The Company’s Board of Directors is providing these proxy materials to you in connection with its solicitation of proxies for use at the Macatawa Bank Corporation 2020 annual meeting of

shareholders. The meeting will take place on Tuesday, May 5, 2020, at 9:00 a.m., local time, at The Pinnacle Center, 3330 Highland Drive, Hudsonville, Michigan 49426. You are invited to

attend the meeting and are requested to vote on the proposals described in this proxy statement.

|

| A. |

We began sending and delivering this proxy statement to our shareholders on approximately March 20, 2020.

|

| (1) |

Election of two directors to hold office for a three year term;

|

| (2) |

Advisory approval of executive compensation (“Proposal 2”); and

|

| (3) |

Ratification of the appointment of BDO USA, LLP as independent auditors for the year ending December 31, 2020 (“Proposal 3”).

|

In addition, any other business that properly comes before the meeting will be considered and voted on at the meeting. As of the date of this proxy statement, we are not aware of any other matters to be

considered and voted on at the meeting.

| Q. |

How does the Company’s Board of Directors recommend that I vote?

|

| A. |

Your Board of Directors recommends that you vote, as follows:

|

| (1) |

FOR election of all director nominees;

|

| (2) |

FOR Proposal 2;

|

| (3) |

FOR Proposal 3.

|

| A. |

You may vote at the annual meeting if you were a shareholder of record of Macatawa common stock at the close of business on March 9, 2020. Each shareholder is entitled to one vote per share of Macatawa common stock on each

matter presented for a shareholder vote at the meeting. As of March 9, 2020, there were 34,113,545 shares of Macatawa common stock outstanding.

|

|

|

|

A.

|

If you hold your shares in “street name,” which means that your shares are registered in the name of a bank,

broker or other nominee (which we collectively refer to as your “broker”), your broker must vote your street name shares in the manner you direct if you provide your broker with proper and timely voting instructions.

Please use the voting forms and instructions provided by your broker or its agent. These forms and instructions typically permit you to give voting instructions by telephone or Internet if you wish. If you are a

street name holder and want to change your vote, you must contact your broker. Please note that you may not vote shares held in street name in person at the annual meeting unless you request and receive a valid proxy from

your broker.

|

| Q. |

Can I change my mind after I return my proxy?

|

| A. |

Yes. You may revoke your proxy at any time before it is voted at the meeting by doing any of the following three things:

|

| ● |

by delivering written notice of revocation to Macatawa’s Secretary, Jon W. Swets, at 10753 Macatawa Drive, Holland, Michigan 49424;

|

| ● |

by delivering a proxy bearing a later date than the proxy that you wish to revoke; or

|

| ● |

by attending the meeting and voting in person.

|

Merely attending the meeting will not, by itself, revoke your proxy. Your latest dated valid vote that we receive is the vote that we will count.

| A. |

If you do not provide your broker with voting instructions, then your broker has discretionary authority to vote your shares on certain “routine” matters. We expect that Proposal 3 will be

considered a routine matter and your broker will have discretionary authority to vote your shares on that proposal. Your broker will not have discretionary authority to vote your shares on election of directors and

Proposal 2 as these are not considered routine matters. It is important that you promptly provide your broker with voting instructions if you want your shares voted on election of

directors and Proposal 2.

|

| Q. |

What are broker non-votes?

|

| A. |

Generally, broker non-votes occur when shares held by a broker in street name for a beneficial owner are not voted with respect to a

particular proposal because the broker has not received voting instructions from the beneficial owner and the broker lacks discretionary voting power to vote those shares.

|

| Q. |

What is the quorum requirement for the annual meeting?

|

| A. |

To conduct business at the annual meeting, a quorum of shareholders must be present. The presence in person or by properly executed proxy of the holders of a majority of all issued and outstanding shares of Macatawa common

stock entitled to vote at the meeting is necessary for a quorum. To determine whether a quorum is present, we will include shares that are present or represented by proxy, including abstentions and shares represented by a

broker non-vote on any matter.

|

| A. |

Election of Directors. A plurality of the shares voting is required to elect directors. This means that, if there are more nominees than positions to be filled, the nominees who

receive the most votes will be elected to the open director positions. Broker non-votes and other shares that are not voted in person or by proxy will not be included in the vote count.

|

|

|

Advisory Approval of Executive Compensation. Proposal 2 will be approved if a majority of the shares that are voted on the proposal at the meeting are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on Proposal 2 in person or by proxy will not be included in the vote count.

Ratification of Appointment of BDO USA, LLP as Independent Auditors. Proposal 3 will be approved if a majority of the shares that are voted on

the proposal at the meeting are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on Proposal 3 in person or by proxy will not be included in the vote count.

Required Vote for Other Matters. We do not know of any other matters to be presented at the meeting. Generally, any other proposal to be voted

on at the meeting would be approved if a majority of the shares that are voted on the proposal at the meeting are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on the proposal in

person or by proxy would not be included in the vote count.

| Q. |

May the annual meeting be adjourned?

|

| A. |

Yes. The shareholders present at the meeting, in person or by proxy, may, by a majority vote, adjourn the meeting despite the absence of a quorum.

|

In addition, our Bylaws allow the Chairman of the Board to adjourn the meeting if a quorum is not present, if disorder arises or if he determines that no further matters may properly come before

the meeting.

If a quorum is not present at the meeting, or if the necessary votes to approve any of the proposals described in this proxy statement have not been obtained, we expect to

adjourn the meeting to solicit additional proxies.

| Q. |

What does it mean if I receive more than one proxy or voting instruction card?

|

| A. |

We will announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K that we will file with the

Securities and Exchange Commission within four business days after the date of the annual meeting.

|

|

|

In this proxy statement, “we,” “us,” “our,” the “Company” and “Macatawa” refer to Macatawa Bank Corporation, the “Bank” refers to Macatawa Bank, and “you” and “your” refer to each shareholder of Macatawa Bank

Corporation.

Election of Directors

The Governance Committee and the Board of Directors have nominated the following individuals for election as a director of Macatawa for a three-year term expiring at the 2023 annual meeting of shareholders:

Birgit M. Klohs

Thomas P. Rosenbach

Biographical information concerning the nominees appears below under the heading “The Board of Directors.”

The proposed nominees are willing to be elected and to serve as a director. If any nominee becomes unable to serve or is otherwise unavailable for election, which we do not anticipate, the incumbent Board of

Directors may select a substitute nominee. If a substitute nominee is selected, the shares represented by your proxy will be voted for the election of the substitute nominee. If a substitute is not selected, all proxies will be voted for the

election of the remaining nominees.

Your Board of Directors and Governance Committee,

which consists entirely of independent directors,

recommend that you vote FOR election of each nominee as a director.

Advisory Approval of Executive Compensation

Section 14A of the Securities Exchange Act of 1934 requires that the Company provide its shareholders with the opportunity to cast a non-binding, advisory vote on the compensation of the named

executive officers, as disclosed pursuant to Item 402 of Regulation S-K in this proxy statement.

This proposal gives you as a shareholder the opportunity to approve or not approve the compensation of the named executive officers through the following resolution:

“Resolved, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the

Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby approved.”

The Company believes that our executive compensation programs appropriately align our named executive officers’ incentives with shareholder interests and are designed

to attract and retain high quality, executive talent. We believe that our executive compensation policies are and have been conservative within the industry and in comparison with the compensation policies of

competitors in the markets that we serve. We also believe that both the Company and shareholders benefit from responsive corporate governance policies and dialogue.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and the philosophy and compensation programs described in

this proxy statement.

The vote is advisory and not binding upon the Company, the Board of Directors or the Compensation Committee, and may not be construed as overruling a decision by the Board or creating an additional

fiduciary duty of the Board. However, the Board of Directors and Compensation Committee value the opinions of our shareholders and will take into account the outcome of the vote when making future decisions

regarding executive compensation.

The Company’s current policy is to provide shareholders with an

opportunity to approve the compensation of the named executive officers on an annual basis. The next such vote will occur at the 2021 annual meeting of shareholders.

Your Board of Directors and Compensation Committee,

which consists entirely of independent directors,

recommend that you vote FOR Proposal 2.

Ratification of Appointment of Independent Auditors

The Audit Committee has appointed BDO USA, LLP as the Company’s independent auditors to audit the financial statements of the Company and its subsidiaries for the year ending December 31, 2020, and to perform such

other appropriate audit services as may be approved by the Audit Committee. The Board of Directors and the Audit Committee propose and recommend that shareholders ratify the appointment of BDO USA, LLP to serve as the Company’s independent

auditors for the year ending December 31, 2020.

More information concerning the relationship of the Company with its independent auditors appears below under the headings “Audit Committee,” “Independent Auditors” and “Audit Committee Report.”

If the shareholders do not ratify the appointment of BDO USA, LLP, the Audit Committee will consider a change in auditors for the next year.

Your Board of Directors and Audit Committee,

which consists entirely of independent directors,

recommend that you vote FOR Proposal 3.

General

The Board of Directors currently consists of 8 directors. The Board of Directors is divided into three classes, with each class as nearly equal in number as possible. Each class of directors serves a three-year

term, with the term of one class expiring at the annual meeting in each successive year.

Qualifications and Biographical Information

The Governance Committee has not established specific, minimum qualifications for director nominees. The Governance Committee will consider candidates for director who have the skills, experiences (whether in

business or in other areas such as public service or academia), particular areas of expertise, and other characteristics to enable them to best contribute to the success of the Company. Director nominees should possess the highest personal and

professional ethics, integrity and values and must be committed to representing the long-term interests of shareholders. Additionally, director nominees should have sufficient time to effectively carry out their duties.

Biographical information concerning the directors and the nominees for election to the Board of Directors, and the specific experience, qualifications, attributes and skills that led to the conclusion of the

Governance Committee and the Board of Directors that the person should serve as a director, is presented below. Except as otherwise indicated, each of these persons has had the same principal position and employment for over five years.

Directors with Terms Expiring in 2023

Birgit M. Klohs, age 68, has been a director of the Company since September 2010 and a director of the Bank since 2003. Ms. Klohs is President &

Chief Executive Officer of The Right Place, Inc., located in Grand Rapids, and has held these positions since 1987. The Right Place, Inc. is the regional economic development organization for the retention, expansion and attraction of businesses

to the West Michigan Area. Ms. Klohs also serves on the ADAC Automotive board of directors, the Priority Health board of directors, the Aeronautics Board of Gerald R. Ford International Airport, the International Crossing Authority, the Grand

Rapids Area Chamber board of directors, the Grand Action Executive Committee, and the Kent County-Grand Rapids Convention/Arena Authority. Her past board memberships include Spectrum Health Systems, Local Development Finance Authority

(SmartZone), Western Michigan University Board of Trustees, Michigan Economic Development Corporation, Grand Rapids Symphony, Economic Club of Grand Rapids, the Van Andel Public Museum, and Heart of West Michigan United Way. Ms. Klohs has

received numerous awards over her distinguished career. Recent awards include the International Economic Development Counsel Jeffrey A. Finkle Organizational Leadership Award for 2016, recognition as one

of Crain’s 100 Most Influential Women in 2016, induction into the Michigan Business and Professional Association Michigan Business Women Hall of Fame in 2017, the

Grand Rapids Economic Club’s Business Person of the Year in 2017, the David and Carol Van Andel Leadership Award in 2017, the

Western Michigan University Distinguished Alumni Award in 2017, a finalist for the Ernst & Young Entrepreneur of the Year in 2018 and named as one of the 50 Most Accomplished Women in Non-Profit Management in 2018. In nominating Ms. Klohs, the Governance Committee considered as important factors her extensive business experience, her extensive work in promoting

economic development in West Michigan, her familiarity with the markets in which we operate, her familiarity with and ability to understand financial statements, and her extensive work for not-for-profit

organizations.

Thomas P. Rosenbach, age 64, has been a director of the Company and the Bank since October 2010. Mr. Rosenbach has been a Partner with Beene Garter LLP, a certified public accounting and tax consulting firm, since 1990 and he currently serves as Managing Partner of the firm. He brings over 30 years of experience in public accounting, specializing in construction,

real estate, manufacturing and wholesale distribution industries. Mr. Rosenbach is a member of the American Institute of Certified Public Accountants, the Michigan Association of Certified Public Accountants and Moore Stephens North America,

where he previously served as chairman. He is active in the West Michigan community, having served on the boards of Pine Rest Christian Hospital and the Associated Builders and

Contractors of West Michigan. He previously served on the audit committee for Pine Rest Christian Hospital. In nominating Mr. Rosenbach, the Governance Committee considered as important factors his extensive accounting and finance experience,

his ability to understand financial statements and qualify as an “audit committee financial expert,” his experience working with public companies, his reputation as a respected business leader in our community, and his extensive community

involvement.

Directors with Terms Expiring in 2022

Charles A. Geenen, age 61, has been a director of the Company since September 2010 and a director of the Bank since 2008. Mr. Geenen has been President

of GDK Construction Co. in Holland since 1982 and is associated with Geenen DeKock Properties LLC, a commercial real estate development company. Mr. Geenen is a licensed builder and licensed real estate sales professional. Mr. Geenen has

previously served on the City of Holland Downtown Development Authority and Strategic Planning Committee and City of Holland Building Board of Appeals as well as the Trinity Christian College Board of Trustees. In nominating Mr. Geenen, the

Governance Committee considered as important factors his extensive business experience, his familiarity with the markets in which we operate, his familiarity with and ability to understand financial statements, and his extensive work for

municipal and not-for-profit organizations.

Robert L. Herr, age 74, has been a director of the Company and the Bank since October 2010. Mr. Herr, a former Partner with Crowe LLP, a public accounting and consulting firm, retired in 2007 after 40 years with the firm. He has worked with private and public clients across many business sectors. Mr. Herr spent over 15 years as a member of the firm’s Financial Institutions Practice, and his experience includes extensive regulatory interaction and knowledge of publicly traded bank holding companies. In addition to his client work, Mr. Herr served for six years on the firm’s executive committee and was the Chair of the firm’s Audit Committee for two years. Mr. Herr also

serves as the Board Chair and is the Chair of the Audit Committee of Agility Health, Inc. (AHI.V - Toronto TSX-V Exchange) which provided rehabilitation services in 18 states nationwide in a variety of settings,

including outpatient clinics, hospitals, long-term care facilities and employer work sites. Mr. Herr is active in the West Michigan community serving as Board Chair of the Downtown Improvement District. He is a Board Member of the Mercy Health

Physicians Partners, Jandernoa Entrepreneurial Mentoring, First Steps Commission, Emmanuel Hospice, Downtown Grand Rapids, Inc., and Western Michigan University Foundation, and Treasurer of the Economic Club of Grand Rapids. He is the past board

chair of St. Mary’s Health Care, YMCA of Greater Grand Rapids and Heart of West Michigan United Way. Mr. Herr was awarded the 2006 National Kidney Foundation’s Galaxy Award for Business, the 2007 Michigan Association of CPS’ Public

Service Award, in 2009 was the initial inductee into the Academy of Outstanding Alumni, of the Department of Accountancy at Western Michigan University and in 2016

was recognized by the Haworth College of Business with an Outstanding Alumni Achievement Award. In nominating Mr. Herr, the Governance Committee considered as important factors his extensive accounting and finance experience, his ability to

understand financial statements and qualify as an “audit committee financial expert,” his experience working with public companies, in particular his work with public financial institutions, his reputation as a respected business leader in our

community, and his extensive community involvement.

Michael K. Le Roy, age 52, has been a director of the Company and the Bank since December 2015. Dr. Le Roy is the President of Calvin University. Dr. Le Roy joined Calvin University in 2012, after serving as the Executive Vice President, Academic Affairs and Dean of Faculty for Whitworth University and earlier as a department chair and associate professor

of political science and international relations at Wheaton College. Dr. Le Roy has been a speaker at the Council of Independent Colleges, the American Council on Education, and the Council for Christian Colleges

and Universities on themes of organizational effectiveness, change management, governance, transparency, risk, and crisis management. He has also presented at continuing education seminars on governance, higher

education finance, risk management, and audit. Dr. Le Roy serves as an ex-officio member of the Calvin University audit committee, and also serves as a member of the board of directors of Michigan Independent

Colleges and Universities. In nominating Dr. Le Roy, the Nominating Committee considered as important factors his familiarity with and ability to understand financial statements, his insights on the fast changing world of higher education and

his professional and educational expertise in our communities.

Directors with Terms Expiring in 2021

Ronald L. Haan, age 66, has been a director of the Company and the Bank since 2009. Mr. Haan is Chief Executive Officer and President of the Company and

the Bank. Mr. Haan served as Executive Vice President of Macatawa Bank from September 2005 until August 12, 2009. Mr. Haan was appointed as a director and Co-Chief Executive Officer, Secretary and Treasurer of the Company on February 9, 2009.

In August 2009, Mr. Haan was appointed Chief Executive Officer and President of the Company and the Bank. Prior to September 2005, Mr. Haan was employed as an Executive Vice President of Fifth Third Bank. Mr. Haan also served as the President

and Chief Operating Officer of Ottawa Financial Corporation and AmeriBank, a position held since 1989. Mr. Haan served as a Director of Ottawa Financial Corporation, and AmeriBank. He has been in banking since 1975 working in various capacities. In addition to banking experience, he has also served in his community by serving as a director of Pine Rest Christian Mental Health, the Barnabas Foundation, Grand Rapids Christian School Association and CRC Loan

Fund, Inc. In nominating Mr. Haan, the Governance Committee considered as important factors his extensive banking experience, his service to and familiarity with the Company, his experience working in public companies, his familiarity with and

ability to understand financial statements, and his community involvement.

Douglas B. Padnos, age 65, has been a director of the Company

since 2009 and a director of the Bank since 2007. Mr. Padnos has been a leader in our business community for many years. After 12 years in sales and sales management in the residential and contract furniture industry, he joined his family

business, Padnos, a recycling company, where he has served as Executive Manager of the Paper and Plastics division since 1989 and now serves as Executive Vice President. He has also

served as President of the Holland Area Arts Council, VP and Trustee of the Grand Rapids Art Museum and has supported other not–for-profit organizations including the Boys & Girls Club and Hospice of Holland.

Mr. Padnos is a 1977 graduate of the University of Michigan. In nominating Mr. Padnos, the Governance Committee considered as important factors his extensive business experience, his familiarity with the markets in which we operate, his

familiarity with and ability to understand financial statements, and his extensive work for not-for-profit organizations.

Richard L. Postma, age 69, has been a director of the Company and the Bank since 2009. Mr. Postma is Chairman of the Board of the Company. Mr. Postma

was selected by the Board of Directors in the fall of 2009 to serve as a director and Chairman because of his stature as a successful and respected business leader in West Michigan. Mr. Postma is Chief Executive Officer and co-founder of U.S.

Signal Company, L.L.C., the Midwest’s largest fiber optic carrier network. Mr. Postma currently holds several leadership positions with a variety of other companies, serving as Chairman of TurnKey Network Solutions,

LLC, a telecommunications contractor focused on infrastructure solutions, R.T. London, Inc., a designer and manufacturer of high-quality durable furniture, and P&V Capital Holdings, L.L.C. He recently served on the Board of Directors of

AboveNet, Inc. (NYSE: ABVT), where he was a member of the Audit Committee, Compensation Committee, and Strategy Committee. AboveNet, Inc. was sold and delisted by way of a sale to Zayo Communications in July of

2012. He has also served as Co-Chairman and Chief Executive Officer of U.S. Xchange, LLC and has previously served on the Board of Directors and the Audit Committee of Choice One Communications, Inc. (NYSE: CWON). Since joining our Company, Mr. Postma has been working very closely with other directors and the Bank’s leadership team to provide strategic direction, improve shareholder value and grow Company

profitability. In nominating Mr. Postma, the Governance Committee considered as important factors his extensive business experience, his reputation as a respected business leader in our community, his experience working with public companies,

his familiarity with and ability to understand financial statements, and his extensive community involvement.

Board Committees

Macatawa’s Board of Directors has three standing committees:

| ● |

Audit Committee

|

| ● |

Compensation Committee

|

| ● |

Governance Committee

|

The table below shows each person currently serving as a director, whether the person is an independent director and each committee on which the person serves.

|

Director

|

Independent

Director(1)

|

Audit

Committee

|

Compensation

Committee

|

Governance

Committee

|

|

Charles A. Geenen

|

Yes

|

Member

|

||

|

Robert L. Herr

|

Yes

|

Member

|

Member

|

|

|

Ronald L. Haan

|

No

|

|||

|

Birgit M. Klohs

|

Yes

|

Member

|

Member

|

|

|

Michael K. Le Roy

|

Yes

|

Member

|

Member

|

|

|

Douglas B. Padnos

|

Yes

|

Member

|

Member

|

|

|

Richard L. Postma

|

Yes

|

Member

|

Chairman

|

Chairman

|

|

Thomas P. Rosenbach

|

Yes

|

Chairman

|

Member

|

Member

|

| (1) |

Independent as that term is defined in Nasdaq Listing Rules for service on the Board of Directors and each committee on which the director serves. In making this determination, the Company considered all

ordinary course loan and other business transactions between the director and Macatawa Bank.

|

Audit Committee

The Board of Directors has established the Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 to assist the Board in fulfilling its duties

with respect to accounting, auditing, financial reporting, internal control, and legal compliance. The Audit Committee oversees management and the independent auditors in the Company’s accounting and financial reporting processes and audits of

the Company’s financial statements. The Audit Committee serves as a focal point for communication among the Board, the independent auditors, the internal auditor and management with regard to accounting, reporting, and internal controls. During 2019, the Audit Committee met eight times.

The Audit Committee represents the Board of Directors in oversight of:

| ● |

the integrity of the financial reports and other financial information disclosed by the Company;

|

| ● |

the Company’s systems of disclosure controls and procedures and internal controls over financial reporting;

|

| ● |

legal compliance and the establishment of a code of ethics;

|

| ● |

independence and performance of the Company’s independent auditors (who are ultimately responsible to the Board of Directors and the Audit Committee);

|

| ● |

the Company’s auditing, accounting and financial reporting processes generally;

|

| ● |

the Bank’s risk management and loan review functions; and

|

| ● |

compliance with orders, agreements, understandings, resolutions or similar commitments or with regulatory agencies with authority over the Company or the Bank.

|

The Audit Committee has the full power and authority to perform the responsibilities of a public company Audit Committee under applicable law, regulations, stock exchange listing standards, generally accepted

accounting principles, and public company custom and practice. The Audit Committee may establish subcommittees of the Audit Committee and delegate authority and responsibility to subcommittees or any individual member of the Audit Committee.

The Audit Committee has the authority to engage consultants, advisors and legal counsel at the expense of the Company.

The Audit Committee must be composed of three or more directors appointed by the Board of Directors, one of whom must be designated by the Board of Directors as the Chair. Each member of the Audit Committee must

be independent of the management of the Company and free of any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as an Audit Committee member. Each member of the Audit

Committee must be an “independent director” as defined by Nasdaq Listing Rules and as required under rules and regulations of the Securities and Exchange Commission. A director may not be a member of the Audit Committee if he or she participated

in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years. Each member of the Audit Committee must be able to read and understand fundamental financial

statements, including the Company’s balance sheet, income statement, and cash flow statement.

At least one member of the Audit Committee must be a person whom the Board has determined has past employment experience in finance or accounting, requisite professional certification in accounting, or any other

comparable experience or background which results in the individual’s financial sophistication and is an “audit committee financial expert” as that term is defined by applicable regulations of the Securities and Exchange Commission. The Board of

Directors has determined that Messrs. Herr and Rosenbach are each an “audit committee financial expert” under rules and regulations of the Securities and Exchange Commission.

The Audit Committee operates under a charter adopted by the Board of Directors. A copy of the Audit Committee Charter is available in the “Investor Relations/Company Overview/Governance Documents” section of our

website, www.macatawabank.com.

Compensation Committee

The Compensation Committee assists the Board of Directors in fulfilling its responsibilities relating to compensation of the Company’s executive officers and the Company’s compensation and benefit programs and

policies. The Compensation Committee has full power and authority to perform the responsibilities of a public company compensation committee under applicable law, regulations, stock exchange rules and public company custom and practice. The

Compensation Committee may establish subcommittees of the committee and delegate authority and responsibility to subcommittees or any individual member of the committee. The Compensation Committee has the authority to engage consultants,

advisors and legal counsel at the expense of the Company. The Compensation Committee did not engage any compensation consultant in 2019. The Compensation Committee met three times in 2019.

The Compensation Committee must be composed of three or more directors appointed by the Board of Directors, one of whom must be designated by the Board of Directors as the Chair. Each member of the Compensation

Committee must be independent of the management of the Company and free of any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as a Compensation Committee member. Each

member of the Compensation Committee must be an “independent director” as defined by Nasdaq Listing Rules and as required under rules and regulations of the Securities and Exchange Commission. In addition, each member of the Compensation

Committee must be a “non-employee director” as defined by Securities and Exchange Commission Rule 16b-3. Each member of the Compensation Committee must be free of any “compensation committee interlock” that would require disclosure by the

Company under Securities and Exchange Commission Regulation S-K, Item 407.

The Compensation Committee operates under a charter adopted by the Board of Directors. A copy of the Compensation Committee Charter is available in the “Investor Relations/Company Overview/Governance Documents”

section of our website, www.macatawabank.com.

Governance Committee

The Governance Committee assists the Board of Directors in fulfilling its responsibilities by providing independent director oversight of nominations for election to the Board of Directors and leadership in the

Company’s corporate governance. The Governance Committee has full power and authority to perform the responsibilities of a public company nominating and governance committee under applicable law, regulations, stock exchange rules and public

company custom and practice. The Governance Committee may establish subcommittees of the committee and delegate authority and responsibility to subcommittees or any individual member of the committee. The Governance Committee has the authority

to engage consultants, advisors and legal counsel at the expense of the Company. During 2019, the Governance Committee met one time.

The Governance Committee must be composed of three or more directors appointed by the Board of Directors, one of whom must be designated by the Board of Directors as the Chair. Each member of the Governance

Committee must be independent of the management of the Company and free of any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as a Governance Committee member. Each

member of the Governance Committee must be an “independent director” as defined by Nasdaq Listing Rules.

The Governance Committee operates pursuant to the Governance Committee Charter, a copy of which is available at the Company’s website, www.macatawabank.com, under the “Investor Relations/Company

Overview/Governance Documents” section.

Corporate Governance Policy

As part of its continuing efforts to improve corporate governance, the Board of Directors has adopted a comprehensive Corporate Governance Policy. The policy is designed to promote

accountability and transparency for the Board of Directors and management of the Company. The policy contains guidelines regarding the responsibilities, membership, and structure of the Board of Directors, including policies addressing:

| • |

Board leadership;

|

| • |

Director independence, qualifications, diversity, education, retirement, evaluation and conflicts of interest; and

|

| • |

Majority vote requirement for uncontested elections

|

The policy also contains guidelines for other significant corporate governance matters, such as the Board of Directors’ responsibility for risk management and succession planning. The Corporate Governance Policy

is available at the Company’s website, www.macatawabank.com, under the “Investor Relations/Company Overview/Governance Documents” section.

Meetings of the Board of Directors

The Company’s Board of Directors had twelve meetings in 2019. During 2019, each director attended at least 75% of the aggregate number of meetings of the Board and Board committees on which he or she served. The

Company encourages members of its Board of Directors to attend the annual meeting of shareholders. All of the directors serving at May 7, 2019 attended the Company’s 2019 annual meeting held on that date.

Meetings of Independent Directors

The Company’s independent directors meet periodically in executive sessions without any management directors in attendance. If the Board of Directors convenes a special meeting, the independent directors may hold

an executive session if the circumstances warrant.

Director Nominations

The Governance Committee is responsible for identifying and recommending qualified individuals to serve as members of the Company’s Board of Directors. The Governance Committee has not established any specific,

minimum qualifications for director nominees. The Governance Committee will consider candidates for director who have the skills, experiences (whether in business or in other areas such as public service or academia), particular areas of

expertise, and other characteristics to enable them to best contribute to the success of the Company. Director nominees should possess the highest personal and professional ethics, integrity and values and must be committed to representing the

long-term interests of shareholders. Additionally, director nominees should have sufficient time to effectively carry out their duties. The Governance Committee considers candidates based on their experience and expertise as well as

demographics to appropriately reflect the diversity and makeup of our community and shareholders. At least annually, the Governance Committee must assess the specific experience, qualifications, attributes, skills and contributions of each

director and nominee to determine whether each director and nominee should serve, or continue to serve, as a director in light of the Company’s business and structure.

The Company’s Articles of Incorporation contain certain procedural requirements applicable to shareholder nominations of directors. Shareholders entitled to vote in the election of directors may nominate a person

to serve as a director if they provide written notice to the Company not later than sixty nor more than ninety days prior to the first anniversary date of the preceding year’s annual meeting, in the case of an annual meeting, and not later than

the close of business on the tenth day following the date on which notice of the meeting was first mailed to shareholders, in the case of a special meeting. The notice must include (1) the name and address of the shareholder who intends to make

the nomination and of the person or persons nominated, (2) a representation that the shareholder is a current record holder of stock entitled to vote at the meeting and will continue to hold those shares through the date of the meeting and

intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (3) a description of all arrangements between the shareholder and each nominee and any other person pursuant to which the nomination

is to be made by the shareholder, (4) the information regarding each nominee as would be required to be included in a proxy statement filed under Regulation 14A of the Securities Exchange Act of 1934 had the nominee been nominated by the Board of

Directors, and (5) the consent of each nominee to serve as a director of the Company if elected. Shareholders may propose nominees for consideration by submitting the required information in writing to: Jon W. Swets, Secretary, Macatawa Bank

Corporation, 10753 Macatawa Drive, Holland, MI 49424-3119.

The Governance Committee will consider every shareholder nomination of a director that complies with the procedural requirements of the Company’s Articles of Incorporation and

report each such nomination and the Governance Committee’s recommendation to the full Board of Directors. The Governance Committee may also, in its discretion, consider shareholders’

informal recommendation of possible nominees.

The Board of Directors and Governance Committee do not currently use the services of any third party search firm to assist in the identification or evaluation of board member candidates. However, the Governance

Committee has the authority to use such a firm in the future if it deems necessary or appropriate.

Leadership Structure

Currently, the Company’s Chairman of the Board and Chief Executive Officer are separate positions in recognition of the difference between the two roles. The Chairman of the Board leads the Board of directors in

adopting an overall strategic plan for the Company, sets the agenda for the meetings of the Board of Directors, presides over all meetings of the Board of Directors, and provides guidance to the Chief Executive Officer. The Chief Executive

Officer implements the strategic plan for the Company as adopted by the Board of Directors and leads the Company, its management and its employees on a day-to-day basis. Because of these differences, the Company currently believes keeping the

Chairman of the Board and Chief Executive Officer as separate positions is the appropriate leadership structure for the Company.

Oversight of Risk Management

The Company is exposed to a variety of risks and undertakes at least annually an enterprise risk management review to identify and evaluate these risks and to develop plans to manage them effectively. During 2019,

the Bank’s enterprise risk management responsibilities were managed by the Chief Operating Officer, Chief Financial Officer, Chief Credit Officer and the Chief Risk Officer.

The Board of Directors, and the Audit Committee under authority and responsibility delegated by the Board of Directors, play a key role in the oversight of the Company’s risk management. To that end, the Board of

Directors or the Audit Committee must periodically require and receive direct reports from the persons holding the following positions (which may be combined):

| • |

Chief Operating Officer

|

| • |

Chief Financial Officer

|

| • |

Chief Risk Officer

|

| • |

Independent Auditor

|

| • |

Chief Credit Officer

|

The Audit Committee, which is composed entirely of independent directors, has authority and responsibility to oversee the Company’s internal audit function, and the risk management and loan review functions of the

Bank. Specifically, the Committee has the authority and responsibility to:

| • |

Oversee each function, including its personnel, resources, organizational structure, and relationship to the Company’s overall business objectives.

|

| • |

Review the independence of the officers responsible for each function.

|

| • |

Inquire into whether the officers responsible for each function have sufficient authority, support, resources, and the necessary access to Company personnel, facilities and records to carry out their work.

|

| • |

Review reports of significant findings and recommendations and management’s corrective action plans.

|

| • |

Establish and maintain channels for the officers responsible for each function to communicate directly with the Committee.

|

| • |

Review the performance of the officers responsible for each function.

|

The Chief Operating Officer, Chief Financial Officer, Chief Credit Officer and Chief Risk Officer meet with the Audit Committee on a quarterly basis to discuss the risks facing Macatawa, and highlight any new risks

that may have arisen since they last met.

The Company has appointed the Chief Risk Officer as the key individual within the Company responsible for independent oversight of the Risk Management process, with direct functional and administrative reporting to

the Audit Committee. The Chief Risk Officer meets quarterly with the Audit Committee and attends all Board of Directors meetings to discuss the risks facing Macatawa. The Chief Risk Officer works closely with members of management, including

the President and Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, Chief Credit Officer, Chief Commercial Banking Officer, Chief Retail Banking Officer, Chief Technology Officer, Chief Human Resources Officer, outside

legal counsel, and others.

The Chief Operating Officer, Chief Financial Officer, Chief Commercial Bank Officer, Chief Retail Banking Officer and Chief Risk Officer attend all regular, monthly meetings of the Board of Directors and report on

credit metrics and risks facing the Bank.

The Loan Review function reports functionally to the Audit Committee and administratively to the Chief Risk Officer.

Majority Voting

The Board believes that the Company and its shareholders are best served by having directors who enjoy the confidence of the Company’s shareholders. If any director receives a greater number of votes “withheld”

than votes “for” election in an uncontested election at an annual meeting of shareholders (a “Majority Withheld Vote”), then the Board will presume that such director does not have the full confidence of the shareholders. A director receiving a

Majority Withheld Vote must promptly offer his or her resignation from the Board to the Governance Committee upon certification of the shareholder vote. The resignation will be effective if and when accepted by the Governance Committee.

The Governance Committee, which consists entirely of independent directors, will promptly consider the acceptance of the director’s offer of resignation. The director at issue will not participate in the

consideration of or the vote on the offer of resignation.

The Governance Committee is expected to consider and vote upon acceptance or rejection of the offer of resignation in its sole discretion not later than the day of the next regularly scheduled meeting of the Board,

which is held more than one week after the annual meeting of shareholders. The Governance Committee is expected to evaluate whether or not the Majority Withheld Vote represented a failure of confidence in the director by the shareholders.

Examples of reasons why the Governance Committee may decline to accept a resignation include, but are not limited to, a conclusion that votes were withheld because of an identifiable cause that has subsequently been adequately addressed or a

belief that the Majority Withheld Vote is attributable to technical issues or deficiencies in the proxy solicitation process.

The Company will disclose the Governance Committee’s decision regarding the director’s offer of resignation (and the reasons for rejecting the resignation offer, if applicable) in

an appropriate filing with the Securities and Exchange Commission.

Term Limits

The Company does not have predetermined term limits for directors. The Governance Committee will evaluate each director’s continued services on the Board annually. In connection with each nomination for

re-election, each director will have an opportunity to confirm his or her desire to continue as a member of the Board.

Retirement

The Board of Directors believes that it is generally appropriate for directors to retire before the age of 70. The Board of Directors recognizes, however, that the wisdom, experience and contribution of a director

aged 70 years or older could benefit the Board and the Governance Committee may, in its discretion, nominate a director for re-election after his or her 70th birthday. In 2019, the Governance Committee and the Board of Directors

specifically considered that director Robert L. Herr would be greater than 70 years of age at the date of the annual meeting of shareholders to be held on May 7, 2019. The Governance Committee and the Board of Directors concluded that the

wisdom, experience and contribution of Mr. Herr will continue to benefit the Board of Directors and determined that it was appropriate to nominate him for re-election. Mr. Herr was nominated and elected to a three year term of service as

director ending in 2022.

Change in Employment or Independence

Directors recognize that they have been chosen for nomination or appointment to the Board of Directors in part because of the knowledge and insight they gain on a continuing basis from their active employment in

their current positions and for the public respect they bring to the Company and its Board of Directors because of the positions they hold in the business community. A director who experiences a material change in his or her employment status

must inform the Governance Committee as soon as practicable and is expected to promptly offer his or her resignation as a director to the Governance Committee. The Governance Committee will consider and vote upon acceptance or rejection of the

director’s offer in its sole discretion, excluding the affected director from consideration of and voting on acceptance of the resignation.

An independent director who ceases to be an independent director under Nasdaq Listing Rules for any reason must inform the Governance Committee as soon as practicable and is expected to promptly offer his or her

resignation as a director to the Governance Committee. The Governance Committee will consider and vote upon acceptance or rejection of the director’s offer in its sole discretion, excluding the affected director from consideration of and voting

on acceptance of the resignation.

Other Board Memberships

Each executive officer of the Company must notify the Governance Committee before serving as a member of the board of directors of any other business organization. The Governance Committee will review executive

officers’ membership on external boards of directors at least annually. The Governance Committee may limit the directorships for any executive officer if it believes that they will interfere with the executive officer’s responsibilities to the

Company.

Shareholder Communication with Directors

The Company provides a process for shareholders to send communications to the Board of Directors. Such communications should be directed to Jon W. Swets, Secretary, Macatawa Bank Corporation, 10753 Macatawa Drive,

Holland, Michigan 49424. The Secretary of the Company, or the Secretary’s delegates, have discretion to adopt policies and procedures to implement and administer this communication process. Shareholder communications may be directed to the

Board of Directors, a committee of the Board of Directors or to specific individual directors. The Secretary has discretion to screen and not forward to directors, communications which the Secretary determines in his or her discretion to be

communications unrelated to the business or governance of the Company and its subsidiaries, commercial solicitations, offensive, obscene or otherwise inappropriate. The Secretary must, however, collect and organize all shareholder communications

which are not forwarded, and such communications must be available to any director upon request.

External Communications

The Board believes that the Chairman of the Board and management of the Company should speak for the Company. Individual Board members who are not the Chairman of the Board or officers should not communicate with

outside parties regarding corporate matters unless authorized by the Board, the Chairman of the Board or management. If so authorized, Board members may communicate with various constituencies that are involved with the Company, subject to

applicable law and the Company’s policies regarding the disclosure of information.

Code of Ethics

As part of its continuing efforts to improve corporate governance, in 2011 the Board of Directors adopted a new and comprehensive Code of Ethics. The code is intended to deter wrongdoing and to promote:

| • |

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

|

| • |

Full, fair, accurate, timely and understandable disclosure in documents the Company files with, or submits to, the SEC and in all public communications made by the Company;

|

| • |

Compliance with applicable governmental laws, rules and regulations; and

|

| • |

Prompt internal reporting to designated persons of violations of the code.

|

The Code of Ethics is available upon request by writing to the Chief Financial Officer, Macatawa Bank Corporation, 10753 Macatawa Drive, Holland, Michigan 49424 and is also available on the Company’s website, www.macatawabank.com,

under the “Investor Relations/Company Overview/Governance Documents” section.

Problem Resolution Policy

The Company strongly encourages employees to raise possible ethical issues. We maintain a problem resolution hotline to receive reports of ethical concerns or incidents, including, without limitation, concerns

about accounting, internal controls or auditing matters. Users of the hotline may choose to remain anonymous. We prohibit retaliatory action against any individual for raising legitimate concerns or questions, or for reporting suspected

violations.

Board Diversity

The Board believes that the Company and its shareholders are best served by having a Board of Directors that brings a diversity of education, experience, skills, and perspective to Board meetings. The Governance

Committee and the Board of Directors will consider such diversity in identifying director nominees. There are no specific or minimum qualifications or criteria for nomination for election or appointment to the Board.

Fees

The aggregate fees billed or to be billed by the Company’s independent auditors to Macatawa and its subsidiaries for 2019 and 2018 were as follows:

|

2019

|

2018

|

|||||||

|

Audit Fees(1)

|

$

|

376,109

|

$

|

287,954

|

||||

|

Audit-Related Fees(2)

|

20,000

|

17,000

|

||||||

|

Tax Fees(3)

|

19,400

|

19,400

|

||||||

|

All Other Fees

|

0

|

0

|

||||||

| (1) |

Audit services consist of the annual audit of the financial statements and internal control over financial reporting, reviews of quarterly reports on Form 10-Q, services that are normally provided in

connection with statutory and regulatory filings or engagements for those fiscal years, and related consultations.

|

| (3) |

Permissible tax services include tax compliance, tax planning and tax advice that do not impair the independence of the auditors and that are consistent with the SEC’s rules on auditor independence. Tax

compliance and preparation fees accounted for $19,400 and $19,400 of the total tax fees for 2019 and 2018, respectively.

|

Audit Committee Approval Policies

The Audit Committee has direct authority and responsibility to pre-approve all audit and permissible non-audit services provided to the Company by the Company’s independent auditors. In accordance with this

authority and responsibility, the Audit Committee pre-approved all services performed by the Company’s independent auditors during 2019 and 2018.

All pre-approvals of audit and permissible non-audit services granted by the Audit Committee must be reasonably detailed as to the particular services to be provided and must not result in the delegation of the

Audit Committee’s pre-approval responsibilities to management. Pre-approvals of services granted by the Audit Committee must not use monetary limits as the only basis for pre-approval and must not provide for broad categorical approvals. Any

pre-approval policies or practices adopted by the Audit Committee must be designed to ensure that the Audit Committee knows what particular services it is being asked to pre-approve so that it can make a well-reasoned assessment of the impact of

the service on the independent auditors’ independence.

The Audit Committee may delegate to one or more designated members of the committee the authority to grant pre-approvals of permissible non-audit services. The decisions of any member to whom this authority is

delegated must be reported to the full Audit Committee.

Non-audit services provided by the Company’s independent auditors must not include any of the following:

| • |

Bookkeeping or other services related to the accounting records or financial statements of the Company;

|

| • |

Financial information systems design and implementation;

|

| • |

Appraisal or valuation services, fairness opinions, or contribution-in-kind reports;

|

| • |

Actuarial services;

|

| • |

Internal audit outsourcing services;

|

| • |

Management functions or human resources;

|

| • |

Broker-dealer, investment adviser, or investment banking services;

|

| • |

Legal services and expert services unrelated to the audit; and

|

| • |

Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible.

|

Appointment of Independent Auditor

The Audit Committee has direct authority and responsibility for the appointment, compensation, retention and oversight of the work of any accounting firm engaged for the purpose of issuing

an audit report and performing other audit, review or attestation services for the Company. The Audit Committee is also directly responsible for the resolution of disagreements between management and the independent auditors regarding financial

reporting. The independent auditors report directly to the Audit Committee.

The Audit Committee must review the performance of the independent auditors of the Company at least annually. The Audit Committee must also review the independence, effectiveness and objectivity of the independent

auditors of the Company at least annually.

The Audit Committee has direct authority and responsibility to oversee the independence of the independent auditors. The Audit Committee must require receipt of, and must review, a formal written statement of the

independent auditors delineating all relationships between the independent auditor and the Company, consistent with the standards of the Public Company Accounting Oversight Board. The Audit Committee must discuss with the independent auditor the

independent auditor’s independence, including a discussion of any disclosed relationships or services that may impact the objectivity and independence of the independent auditor. If the Audit Committee is not satisfied with the independent

auditors’ assurances of independence, it must take or recommend to the full Board of Directors appropriate action to ensure the independence of the independent auditors.

The Audit Committee must discuss with the independent auditors the matters required to be discussed by applicable legal, regulatory, and stock exchange listing rule requirements relating to the conduct of the audit

and any qualifications in the independent auditors’ audit opinion.

The Audit Committee has appointed BDO USA, LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2020. BDO USA, LLP also served as the Company’s independent

registered public accounting firm for the year ended December 31, 2019. BDO USA, LLP began serving as the Company’s independent registered public accounting firm for the year ended December 31, 2010. Representatives of BDO USA, LLP are expected

to be present at the annual meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders.

The following is the report of the Audit Committee with respect to the Company’s audited financial statements as of and for the year ended December 31, 2019. The information contained in this

report shall not be deemed “soliciting material” or otherwise considered “filed” with the SEC, and such information shall not be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of

1934 except to the extent that the Company specifically incorporates such information by reference in such filing.

The Audit Committee has reviewed, and discussed with management and the independent auditors, the Company’s audited financial statements as of and for the year ended December 31, 2019, management’s assessment of

the effectiveness of the Company’s internal control over financial reporting, and the independent auditors’ attestation report on the Company’s internal control over financial reporting. The Audit Committee has discussed with the independent

auditors the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301. The Audit Committee has received the written disclosures and the letter from the independent auditors required by

applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence, and has discussed with the independent auditors the independent auditors’ independence. This included consideration of the compatibility of non-audit services with the auditors’ independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2019 for filing with the Securities and Exchange Commission.

Management is responsible for the Company’s financial reporting process, including its systems of internal control, and for the preparation of financial statements in accordance with generally accepted accounting

principles. The Company’s independent auditors are responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. It is not our duty or our responsibility to

conduct auditing or accounting reviews or procedures, and therefore our discussions with management and the independent auditors do not assure that the financial statements are presented in accordance with generally accepted accounting

principles. We have relied, without independent verification, on management’s representation that the financial statements have been prepared in conformity with U.S. generally accepted accounting principles and on the representations of the

independent auditors included in their report on the Company’s financial statements.

Respectfully submitted,

|

Thomas P. Rosenbach, Chairman

|

Robert L. Herr

|

Birgit M. Klohs

|

| Michael K. Le Roy | Richard L. Postma |

Our executive officers are appointed annually by, and serve at the pleasure of, the Board of Directors or the Chief Executive Officer.

Biographical information for Mr. Haan is included above under “Board of Directors”. The following sets forth biographical information as of March 20, 2020 concerning our executive officers who are not directors:

Craig A. Hankinson, age 52, was appointed to the position of Chief Operating Officer of the Company and the Bank on February 1, 2017. He served as the

Senior Vice President and Chief Credit Officer of the Company and the Bank from November 2010 through January 2017. Mr. Hankinson has 31 years of banking experience in the West Michigan and broader Midwest regional market. Before joining the

Company in 2010, he served as Senior Credit Officer of the business banking group for Fifth Third Bank. Previously, he served as Senior Affiliate Credit Officer, also with Fifth Third Bank, where he directed a

commercial loan portfolio comprising middle market, commercial real estate and business banking credit relationships. Earlier in his career, he held retail, private and commercial banking positions with AmeriBank and Comerica Bank.

Jon W. Swets, age 54, has been Senior Vice President and Chief Financial Officer of the Company and the Bank since July 1, 2002. Prior to joining the

Company, Mr. Swets served as an audit partner at Crowe LLP. Mr. Swets also served as Chief Financial Officer for several years at AmeriBank in Holland, Michigan until its acquisition by Fifth Third Bank. In addition to his public accounting and

banking experience, Mr. Swets has also served in his community as a director at Pine Rest Christian Mental Health Services, Grandville Calvin Christian Schools and Foundation, Camp Roger, and CRC Loan Fund.

Timothy J. Doyle, age 57, has been Senior Vice President of the Company since March 2019 and is currently Senior Vice President, Chief Commercial Banking

Officer of the Bank. Mr. Doyle is a career banker, having served as Regional Head, Senior Commercial Lead for Fifth Third Bank Chicago and West Michigan markets from 1999 until joining Macatawa. Mr. Doyle also has prior bank experience at

Norwest Bank and Associated Bank from 1993 until 1999. He served on the executive board for the Michigan Bankers Association, finishing as Chairman in 2012.

Jill A. Walcott, age 53, has been Senior Vice President of the Company since 2002 and is currently Senior Vice President, Chief Retail Banking Officer of

the Bank. Ms. Walcott began with the Bank in 1997 as Vice President, Branch Administrator and was promoted to Senior Vice President in 2002. Current areas of oversight include Retail Banking, Retail Lending, and Loan Servicing. Ms. Walcott also

serves on the board of directors for Frederik Meijer Gardens and Michigan Turkey Producers.

Compensation Discussion and Analysis

This section discusses material elements of the Company’s compensation of the named executive officers and other matters relevant to the Company’s

compensation program.

Overview. The Compensation Committee (the “Committee”) assists the board of directors in discharging its responsibilities relating to

executive compensation and in fulfilling its responsibilities relating to Macatawa’s compensation and benefit programs and policies. The Committee has the authority and

responsibility to, among other things: determine and oversee the Company’s executive compensation philosophy, structure, policies and programs; assess whether the Company’s

compensation structure establishes appropriate incentives for officers and employees; administer or make recommendations to the Board of Directors with respect to compensation and benefit plans; approve stock incentive awards under the Company’s stock incentive plans; and recommend to the Board of Directors for approval the base salary and long-term incentive compensation award opportunities of the executive officers.

The Committee currently consists of six directors, all of whom are independent under Nasdaq Listing Rules. The Committee receives recommendations from Macatawa’s Chief Executive

Officer regarding the compensation of executive and senior management (other than the compensation of the Chief Executive Officer).

Comparative Analysis. In 2019, the Company engaged McLagan, AON Hewitt, a compensation consultant, to provide a market analysis of

the Company’s compensation practices. This analysis covered base salary, annual incentives, total cash compensation, long-term incentives, and total compensation for approximately 154 positions (approximately 360

individuals) including positions comparable to those of the 5 named executive officers. The analysis included a comparison of Macatawa’s compensation programs against financial

service companies that are similar to the Company in size and scope of operations as reported in the McLagan Financial Services Compensation Survey. This consultant was not selected or engaged by the Compensation Committee and was not engaged to

and did not provide advice or recommendations to the Compensation Committee and, although the Compensation Committee had access to the data in the study and considered that data in its compensation decisions, this consultant was not engaged for

the purpose of developing or providing an analysis for the Compensation Committee. McLagan did not provide any other services to Macatawa in 2019. Because of the objective nature and broader purpose of this survey, the Compensation Committee

does not consider any risk of conflict of interest to be a material consideration.

In 2019, the Company considered this information to help inform its decision-making process to establish total compensation levels that it believes are competitive and in line with the market.

Compensation Philosophy and Objectives. Macatawa’s philosophy is to maximize long-term shareholder return consistent with its

commitments to maintain the safety and soundness of the institution and provide the highest possible level of service at a fair price to the customers and communities that it serves. To do this, the Committee

believes the Company must provide competitive salaries and appropriate incentives to achieve long-term shareholder return. The Company’s executive compensation policies are designed to achieve four primary

objectives:

| • |

provide incentives for achievement of long-term shareholder return;

|

| • |